... Matthew 7:15.

... Matthew 7:15.

If the SECU Board and Executive Leadership Team (ELT) intend to operate SECU as a for-profit "bank", you can be assured that means the importance of SECU employees will soon begin "to come second" - often a distant second - in SECU's "strategic planning". After all, banks (and SECU recently!) like nothing better than to proclaim record profits. That's their purpose! That's the banking "industry standard" !

That " industry standard" may already be in motion at SECU, if the many comments on health benefits, compensation, promotions, "PTO", shift bidding, "module training", stalled comp surveys/career paths, under-staffing in branches, "hire from outside first", and low morale are accurate.

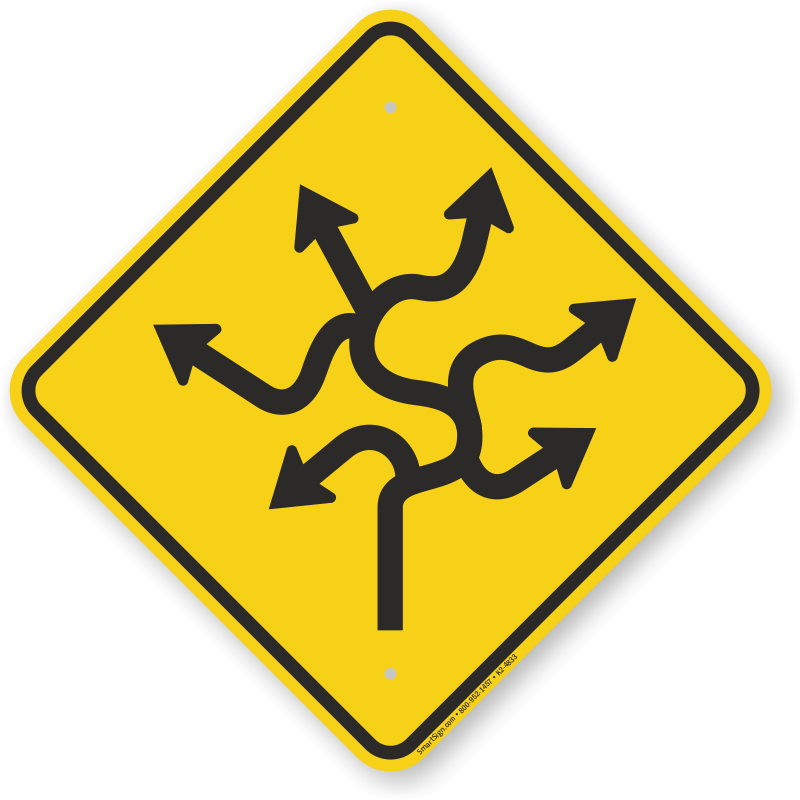

The costs of employee salaries and benefits are the largest expense items for most financial institutions - usually @ 65-70% of total operating expenses. With the "industry standard" model, if employees are viewed as "just another cost input" hindering profits, then SECU employees might want to look closely at the top picture to consider their precarious situation. And, what the future may hold for their "career" - the work which supports their obligations, their hopes, their families....

The "unannounced" SECU Board scheme to cap post retirement benefits for active long-term employees and retirees appears to be yet another example of a leadership lapse creating confusion in the trenches as employees attempt to make day-to-day operating decisions without a clear policy framework - or sense of principles and purpose.

The "unannounced" SECU Board scheme to cap post retirement benefits for active long-term employees and retirees appears to be yet another example of a leadership lapse creating confusion in the trenches as employees attempt to make day-to-day operating decisions without a clear policy framework - or sense of principles and purpose.

😎 The SECU covenant with employees? What were the elements of that idea? Good question, let's take a look! Have things really changed...?

Hope not... but the signs are not encouraging.