1 + 1 ≠ whatever !

😎 The "2:13pm/3:16pm commenter" is at it again! [see 6/28 and 6/29 posts and comments for the continuing saga]

1 + 1 ≠ whatever !

😎 The "2:13pm/3:16pm commenter" is at it again! [see 6/28 and 6/29 posts and comments for the continuing saga]

.

.

.. refer to the comments in the 6/27/2024 post [here's the link], if you want to see how this "Ed story" unfolds.

😎 Well, the "2:13pm/3:16pm commenter" is back! Still squirming frantically - trying to avoid "the light".

❇"some follow up to @6:27."

"1) Yes, SECU grew. Strongly? Compared to what? It's been shown not to have grown as fast as the local market."

As Cool Hand Luke was told: "What we have here is a failure to communicate."

The core problem may be that our "2:13/3:16 commenter" is simply of

the classic persona-types best described by the axiom: "Can't see the

forest for the trees."

So, "2:13/3:16 commenter": "Compared to what?" The bigger

picture? SECU, as you know, is the second largest CU in the US at @ $50

billion in assets - give or take a $5 billion "prop up" loan from the Fed.

(NavyFed in Virginia is by far the largest).

If CU size and

growth are related to population, etc as our commenter opines, then lets

fact-check that statement with a little broader and more fairly balanced vision.

North Carolina is the 9th most populous state in the US and at $50 billion+-, SECU is by far the largest CU in the State.

✅ Here's a list of the 10 most populous states in the US with the asset size of the largest CU in each state:

1. California - $29 billion

2. Texas - $18 billion

3. Florida - $16 billion

4. New York - $12 billion

5. Pennsylvania - $8 billion

6. Illinois - $19 billion

7. Ohio - $8 billion

8. Georgia - $10 billion

9. North Carolina - $50 billion

10. Michigan - $12 billion

... why is SECU so far ahead in terms of size, if population is the

key? (In case you're wondering, SC - $5 billion, Tn - $8 billion). Clearly something unique has been happening in North Carolina!

✅ Something doesn't "add up", does it? And that's the concern about the escalating lending losses and

delinquency at SECU. Those soaring costs "are adding up" at the expense

of the SECU membership. Look closely, isn't SECU a unicorn?

... through the roof!

... through the roof!

Many SECU members have expressed their strong opposition to the discriminatory overcharging of risk-based lending (RBL), which is highly correlated to the race, age and gender of a member . The wrong members are being unfairly overcharged for the wrong reasons, which is detrimental to the financial health of the members - and ultimately catastrophic for the reputation of the Credit Union.

The SECU Board - and particularly the Executive Leadership Team (ELT) - have pooh-poohed those concerns and trumpeted the great improvements in efficiency and effectiveness that "tier-based pricing" (TBP) has brought to SECU lending!

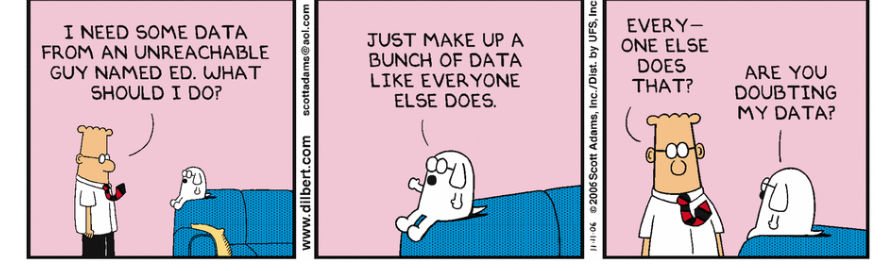

When members point out that the financial results - in terms of loan losses and loan delinquency - don't support those claims, the ELT becomes a bit miffed and has pouted authoritatively that those poor results are "industry standard". "Everybody" is suffering increased losses and delinquency due to rising rates, the Fed, mounting inflation, a weak N.C. economy, climate change, 2024 being a "leap year", the phases of the moon, and global warming, i.e. - "It's not our fault!"

The surge in loan losses and delinquency under "RBL/TBP" is costing the SECU membership literally hundreds of millions of dollars each year now.

✅ Let's take a look at how the 10 largest credit unions in North Carolina are faring with loan delinquency under exactly the same economic circumstances as SECU!

(Name of CU and 60-day delinquency rate at March 31, 2024)

✅ You'll note that all the other large credit unions in North Carolina (except Local Government*) are managing their loans with a delinquency rate generally less than one half the rate of SECU - regardless of the Fed, climate change, or the phase of the moon.

✅ You might also like to note the SECU 60-day delinquency rate was 1.16% at March 31, 2019 vs. 2.07% in 2024 - granted 2019 wasn't a leap year!

This is not a minor matter for SECU, regardless of the pouting!

* SECU makes and "collects" most Local Gov't loans - the 2.67% ratio may be one reason why LGFCU is seeking "independence"!

... But don't hold your breath!

... But don't hold your breath!

🐱 From SECU Corporate Secretary:: Thank you for your inquiry regarding the names and bios of the Nominating Committee members. Members of the Nominating Committee are:

... it's incumbent on the Committee to search diligently.

... caring, costly, crucial.

... caring, costly, crucial.

Healthcare as a benefit is not the most logical place to start a discussion of a covenant with SECU employees, but since we've touched that "third rail" already ...

Providing health insurance for employees - both active and retired - has always been a challenge for SECU and all employers. For example, N.C. State Treasurer Dale Folwell is currently before the Legislature seeking $300+ million to boost the financial soundness of the State Health Plan, which covers over 800,000 North Carolinians. The majority of people obtain coverage through their employer, which helps lower costs and provides employees with the advantage of a skilled administrator - working on their behalf.

Healthcare insurance is both a financial and an ethical dilemma for an employer. How an employer chooses to wrestle with those two difficult issues speaks clearly to an employer's core values - SECU is no exception.

The puzzle confronted with healthcare starts with the fact that your health is quite often a random, "luck of the draw" blessing or problem. People, for the most part, can't choose their personal health profile - or else we would all choose "healthy" over "unhealthy". We can all work on diet, exercise, alcohol, and tobacco; but genetics, a physical disability, a chronic disease, a difficult pregnancy, or a catastrophic auto accident may strike any of us - at any time. Plus - due to the cost (and a little fear!) - many of us unwisely delay seeking healthcare when problems first arise.

Add to the puzzle that young employees believe they don't need coverage, older employees can't live without it; and when incurred, medical costs are astronomical and well beyond the budgets of most families.

In the past, the SECU Board decided that providing healthcare coverage to all employees was an ethical necessity and a professional requirement for the credit union. The basics were as follows:

The simple goal was an attempt to administer the health coverage as a broad, single cooperative pool. Everybody had the same stake in the game! No one would be preferred, no one would be cut out, everyone was in the same "self-interest" boat! The responsibility of the credit union was to the individual employee, coverage would be equal for all - regardless of employee position or status - active or retired.

Many employers are trying to solve "the healthcare puzzle" by shifting the future liability of rocketing costs entirely to employees. Fixed dollar employee healthcare "allowances" cap the financial risk of rising costs for SECU. Good finance perhaps, but certainly poor ethics in SECU employee relations.

By capping the retired health benefits of most current employees and retirees - and by eliminating retired health benefits entirely for new SECU employees - the principles and ethics of healthcare at SECU appear to have changed. New, young SECU employees were evidently misguided into giving up this important benefit. Now longer-term employees and retirees are apparently on the chopping block. SECU employees - active and retired - should pay close attention to any proposed changes. The SECU Board and ELT may no longer be working in your best interests.

The suspicion is that the SECU Board now values "a most profitable year ever" over and above the healthcare interests of current and retired SECU employees and their families.

Starting to see a pattern here?... yet another unhealthy unforced error?