I want to first thank you for your service to the NC SECU. It is a big commitment and I hope it is and continues to be rewarding for you.

In May of 1975, my husband had just graduated from NCSU in Accountancy & Economics and didn't yet have a job. I had been taking my classes over the last 3 years while working full time as a classroom teacher. Our first child was due next month, my paycheck was ending for the summer, and his GI Bill ended at graduation. We both drove volkswagens, so a larger car, though not necessary, would be a better family option. I went to the loan officer who knew me as an undergraduate at UNC. He knew I worked part time while going to school, had graduated in three and a half years, and that my parents had been long standing members of the credit union with good credit histories. I doubt we even had a credit score but he knew I would pay back the loan, so he granted us a car loan. That loan came from the policy of the Credit Union of having

staff from the community working in the community branch and it was a win for both us and the credit union.

Since that time, I have payed it forward serving in many volunteer capacities. For the credit union, I have served on the loan review committee for more years than I can remember. There were changes to the committees expanding from centrally located committees in Raleigh only to statewide regional committees to a single committee for an entire city or group of branches within a city. These changes were based on member needs for quicker turnaround, not having to travel so far to appeal a branch decision, and decisions being made based on knowledge of the people in the community. When reviewing loans, I brought specialized knowledge of how to read a tax return or understand the cash flow of an investment vs. the taxable income but as that expectant mother on the verge of a new career, I understood the personal side of a request.

I remember one member turned down by the branch who had a terrible credit history. She explained to our review committee that her husband had left her five years before with enormous credit card debt and 5 kids to feed. Since that time, she had worked two jobs and finally paid off all the debt, a fact which was verified by the reader. That woman deserved that loan and it was granted. Risk based lending in a case like this would be unaffordable. Despite being the second largest credit union in the US, we write off less than 1% of our loans. That includes the times when we had basic transportation loans, mortgages over 100% of appraisal, reverse mortgages, real estate downturns and refinancing mortgages at no cost automatically as the rates went down. I don't have access to the statistics but I would conjecture that 60-70% of our membership would be penalized by this practice even though they pay back their loans. The payroll deduction option makes that possible. I, for one, and many of my friends and associates that I have talked to are willing to forego a percentage point of interest to pay it forward.

Enlarging the credit union, bringing in outside members and employees, and growth may have some unexpected consequences. When we become just like every other institution, we lose who we are and will, in my opinion, lose membership in the long run. Another concept I would like to see statistics on. Most of all, as an advisory board member at the Centennial Campus and a person who reads the

newsletter that comes with my statement, I was shocked to find out about the change of direction by the Board at the Annual Meeting. As the NC SECU Foundation Board of Directors know, I read the press releases that come to the advisory board members and share them with my friends and acquaintances as I am expected to do. With all these opportunities to bring things to the attention of members of the organization which you represent, do you not feel an obligation to ask us about your policies directing our funds or inform us of your intentions to change our underlying policies that got us where we are today? Since we have become the second largest credit union in the US, with profits every quarter of our existence, I hope you will reflect on the prior policies you are looking to change and consider the value of keeping our core values the same.

As a systems accountant, I enjoy innovation and progress. I have worked for many agencies including those with the largest budgets in state government, for corporate entities including ones owned by icons in the financial and development worlds, and even for the university as both a professor and an accountant. Accountants see the value in technology and the opportunities it can bring. So I do not see myself as someone averse to change. I do believe, however, in risk/reward analysis, paying it forward, focusing on the membership needs and benefits, and transparency. I hope that you believe in the same values. I ask for a timely and thorough response to the Resolution presented which was passed without objection at the 2022 Annual Meeting. I look forward to hearing from you soon.

I now do have a credit score. I also have a relationship with a community bank because I believe in diversity of investments. I know other members do as well. That's why I think some of these changes may have unintended consequences. I hope you will revisit and reconsider some of these changes.

Barbara Perkins

Former LRC Committee member

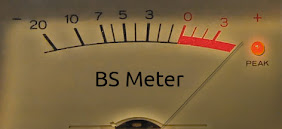

"Ya reckon that the "A" paper folks aren't going to beat down your door "to take advantage" of SECU's higher used car rate - 5.75%, "while the SECU Board takes advantage" of all the B,C,D,E folks by charging even higher rates?!!!