With RBL: Yeah, just keep digging!

😎 According to SECU, lending to members of more modest means - y'know, the average working man and woman in North Carolina - is financially dangerous. The loan losses from those B, C, D, E and F'ers are just astronomical and imperil the safety and soundness of the Credit Union.

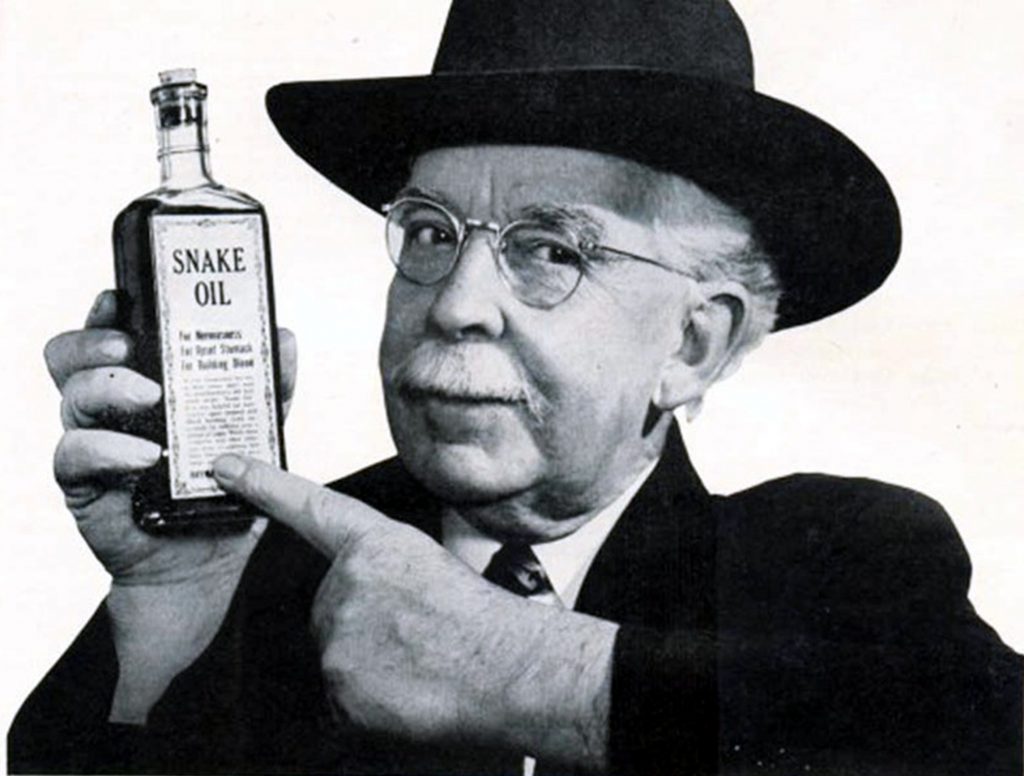

Evidently, some SECU executive and lending folks shot that "bull" to the SECU Board, who bought it hook, line and stinker. Rumor has it, they even con-jured up a noted con-sultant with a faux English accent, to con-vince the SECU Board of its con-temptible ignorance and Neandrathal thinking on the risk-based lending con-cept. Apparently con-cerned by its backwardness and con-vulsed with con-ventionalism, the Board, unfortunately, con-sumed the snake oil.

Evidently, some SECU executive and lending folks shot that "bull" to the SECU Board, who bought it hook, line and stinker. Rumor has it, they even con-jured up a noted con-sultant with a faux English accent, to con-vince the SECU Board of its con-temptible ignorance and Neandrathal thinking on the risk-based lending con-cept. Apparently con-cerned by its backwardness and con-vulsed with con-ventionalism, the Board, unfortunately, con-sumed the snake oil.

After all, "Everybody else is doing it"!

✅ Well, just for the record, here are the real data on loan losses - the ratio of charge-offs (CO's) divided by average loans at SECU. The data comes directly from the chief federal regulator of credit unions, the National Credit Union Administration (NCUA). The loan loss ratios are as of December 31 of each year for the last 15 years. You'll note that the NCUA also provides a "Peer ratio", representing the average loan losses at other very large credit unions similar to SECU:

Year-ending SECU CO's Ratio Peer CO's Ratio

2008 .13% .79%

2009 .20% 1.16%

2010 .23% 1.10%

2011 .26% .89%

2012 .29% .71%

2013 .21% .52%

2014 .20% .45%

2015 .26% .42%

2016 .33% .47%

2017 .40% .50%

2018 .45% .48%

2019 .43% .46%

2020 .30% .46%

2021 .20% .19%

2022 .35% .24%

2023 (9/30) .52% (Available 12/31)

😎 So, not too hard to recognize that in terms of overall loan losses the "same rate for all" lending model at SECU out-performed the risk-based lending model used by other large credit unions. And that historically, SECU loan losses never exceeded 1/2 of 1%. SECU members have always been faithful in repaying their loans - which were made, monitored and collected by a well-trained, home-grown, SECU branch-led lending staff.

Hard to con-tradict reality, isn't it .

...wait it looks like something did change around the end of 2021!

Wonder what that was?