With RBL: Yeah, just keep digging!

😎 According to SECU, lending to members of more modest means - y'know, the average working man and woman in North Carolina - is financially dangerous. The loan losses from those B, C, D, E and F'ers are just astronomical and imperil the safety and soundness of the Credit Union.

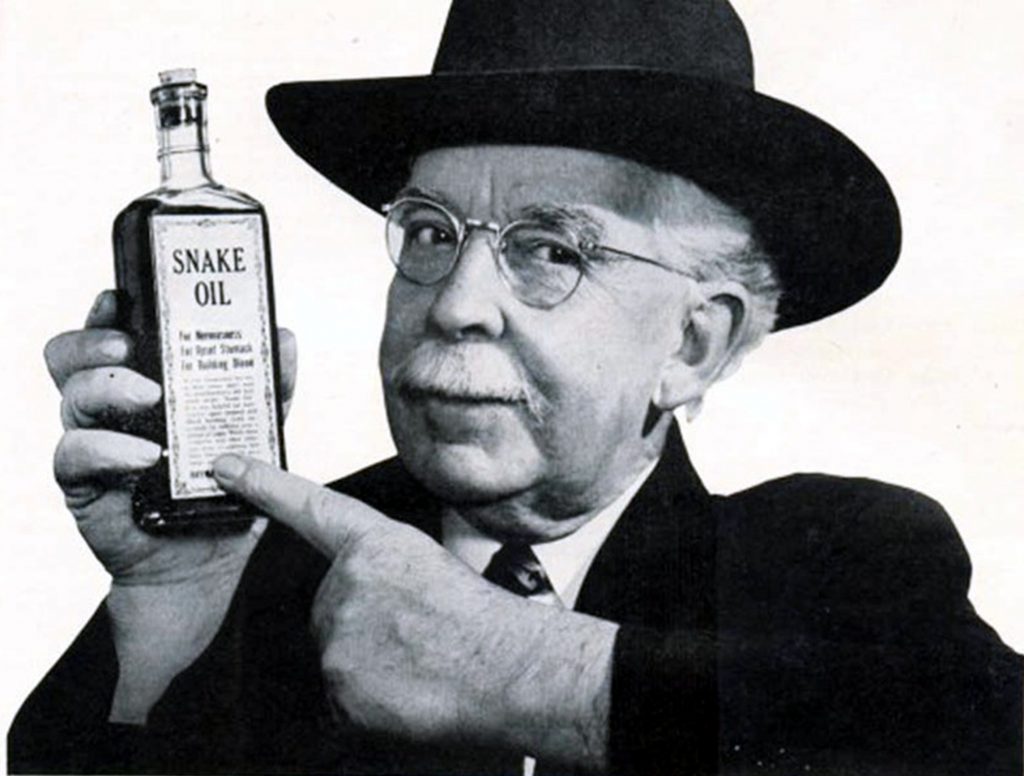

Evidently, some SECU executive and lending folks shot that "bull" to the SECU Board, who bought it hook, line and stinker. Rumor has it, they even con-jured up a noted con-sultant with a faux English accent, to con-vince the SECU Board of its con-temptible ignorance and Neandrathal thinking on the risk-based lending con-cept. Apparently con-cerned by its backwardness and con-vulsed with con-ventionalism, the Board, unfortunately, con-sumed the snake oil.

Evidently, some SECU executive and lending folks shot that "bull" to the SECU Board, who bought it hook, line and stinker. Rumor has it, they even con-jured up a noted con-sultant with a faux English accent, to con-vince the SECU Board of its con-temptible ignorance and Neandrathal thinking on the risk-based lending con-cept. Apparently con-cerned by its backwardness and con-vulsed with con-ventionalism, the Board, unfortunately, con-sumed the snake oil.

After all, "Everybody else is doing it"!

✅ Well, just for the record, here are the real data on loan losses - the ratio of charge-offs (CO's) divided by average loans at SECU. The data comes directly from the chief federal regulator of credit unions, the National Credit Union Administration (NCUA). The loan loss ratios are as of December 31 of each year for the last 15 years. You'll note that the NCUA also provides a "Peer ratio", representing the average loan losses at other very large credit unions similar to SECU:

Year-ending SECU CO's Ratio Peer CO's Ratio

2008 .13% .79%

2009 .20% 1.16%

2010 .23% 1.10%

2011 .26% .89%

2012 .29% .71%

2013 .21% .52%

2014 .20% .45%

2015 .26% .42%

2016 .33% .47%

2017 .40% .50%

2018 .45% .48%

2019 .43% .46%

2020 .30% .46%

2021 .20% .19%

2022 .35% .24%

2023 (9/30) .52% (Available 12/31)

😎 So, not too hard to recognize that in terms of overall loan losses the "same rate for all" lending model at SECU out-performed the risk-based lending model used by other large credit unions. And that historically, SECU loan losses never exceeded 1/2 of 1%. SECU members have always been faithful in repaying their loans - which were made, monitored and collected by a well-trained, home-grown, SECU branch-led lending staff.

Hard to con-tradict reality, isn't it .

...wait it looks like something did change around the end of 2021!

Wonder what that was?

This just shows SECU’s reliance on mortgage volume to maintain low charge offs. SECU launched the map program in 08 and modified or refinanced a crazy amount of mortgages instead of charging off.

ReplyDeleteWonder what those ratios are like per product and further stratified by credit tier.

ReplyDeleteHow much were the servicing costs by product for each year? By credit tier within each product each year?

ReplyDeleteYes, agree with you! Loan Administration (LA) should provide the SECU Board with detailed current and historical data on actual losses by product, by tier, by branch/contact center, by loan officer, and by individual credit score - all this information is readily available. Wonder if the SECU Board knows that?

ReplyDeleteThe Board, as I'm sure you would agree, should require LA to publish loss data to the membership. What is there to hide?

The Board might also consider letting several of our SECU members who are statistical whizzes in our University system independently review the loan loss data and give them some con-crete opinions.

Isn’t profitability something you would have monitored while CEO?

ReplyDeleteAt 8:11 AM - No. SECU is a member-owned, non-profit . Repeat after me non-profit, non-profit, non-profit, non-profit.... keep doing it until it sinks in.

DeleteNon profit requires a profit to give back. Repeat after me not a charity, not a charity, not a charity.

DeleteNo, you just don't get it and keep repeating your mistake! The SECU doesn't "give back" to the membership through "profits" - like that record $587 million "profit" of which our CEO is so unjustly proud. SECU members weren't "given back" any of that $587 million in "profits"!

DeleteWHY DO YOU THINK SECU MEMBERS ARE PULLING OUT THEIR DEPOSITS???

How can you give back to me what is mine already?

DeleteWhy do you keep pointing to loan administration? Wouldn’t profitability fall under accounting?

ReplyDeleteAt 8:14 AM -The question indicates a major part of the current dilemma at SECU! Why would you focus on "profitability" at a non-profit credit union. That's not how the game is played, and that's why "There - Really! - Is A Difference" at SECU. It's not a for-profit bank - was never intended to be one.

Deleteas mom said, 'LISTEN' and they will tell you EXACTLY how they think ... they should find their 'passion' elsewhere ... there is no lacking of that thought process in our world. The road is wide for you to seek your nirvana ...

DeleteSECU isn’t a non profit. It’s not for profit. There is a difference. Not for profit requires profit to be given back to members (ie no outside shareholders). It still requires a profit. Repeat after me, not a charity, not a charity, not a charity.

DeleteAt 9:06 AM - Not exactly displaying your wisdom! But, keep digging... it's helping the cause!

DeleteDo you mean the Member-OWNERS, 9:06 AM? Your view seems elitist there. If you own investments, is getting a return on that considered charity? Or is that return the whole point?

DeleteAlso for 9:06 AM - Can agree with you if you want to make a distinction between "non-profit" and "not for profit". So according to your precise, well-reasoned claim about SECU: "It's not for profit".

DeleteHate to point this out, but read your claim slowly... NOT for PROFIT, NOT for PROFIT, NOT for PROFIT, NOT for PROFIT....

Thanks for your help...keep digging!

Not-for-profit doesn’t mean that credit unions don’t make money. They certainly turn a profit — but the profit is returned to members in the form of lower fees, lower loan interest rates or higher rates on member savings.

DeleteBingo! to 10:14AM...but unfortunately the SECU members who save especially got the shaft - instead of a fair rate - in 2023! SECU savers became "non-profits"...e-r-r make that "not for profits" during 2023!

Delete"Wonder if the SECU Board knows that?"

ReplyDeleteThey should it's what they "signed" up for ... not for SECU paid vacations to Duck and Hawaii ....

At 7:59 AM . Agree again! Add that to the list which Loan Administration must provide to the SECU Board and publish to the membership... and to independent parties for validation and recommendation. Great idea!

ReplyDeleteAs usual most of the people making these policy rules either forgot what it was like to struggle, or have never had to worry about where their next meal was coming from or if there would be one... you can't have empathy if you've never walked in those shoes ...

ReplyDeleteyes you can have empathy with out having experienced poverty and struggle.

Deleteso then maybe you should sit down in the branch with those that have fell on hard times and explain to them why SECU uses RBL now instead of all members receiving the same rate... let me know how it goes ...

DeleteRBL is nothing more than “the science of social engineering”! When AI takes over (oh it's here but it's just starting), there will only be a small fraction of people that will qualify as 'A' paper... and you'll never get the truth on THAT algorithm! 'Someone' has to pay the mounting bills ...

ReplyDeleteIf everyone paid as agreed, then there would be no point in a credit score.

DeleteAt 8:47 AM - Agree! There really is no point in a credit score ! Credit report - yes; credit score not so much.

DeleteAnd under any circumstance, using an inaccurate, discriminatory credit score to unjustly overcharge a blameless individual member is... well, what you call it?

And, for 7:49 AM: A comment by someone who has obviously never had any branch experience; probably thinks like a former commenter who said Loan Administration's only purpose is "to make a profit"; and certainly exhibits a high disdain for those members who encountered financial difficulty in the fraudulent banking collapse which began in 2008 - do we need to re-review Wescorp?

ReplyDeleteFraudulent banking, paired with inept regulatory insight nearly brought the Country to its knees - sideswiping millions of innocent workers who lost their jobs because of it !

But why is this comment really silly and foolish? SECU didn't have to charge-off those loans because it 1) stood by those SECU members in their direst time of need, 2) and the members repaid those loans as they got back on their feet, 3) kept their homes without disrupting their families and 4) became life long advocates for their credit union - SECU!

Sorry, some folks just don't get the real financial value - and never will - of "Do the Right Thing" - to all members.

We could include the Savings & Loans crisis (there's always something with these folks)...

DeleteJames and Younger without the firearms ...

'they' just use silent weapons of mass destruction for most of the working class!

SECU worked hard to assist in members’ financial recovery and it paid off. Now we have the disaster of a central collection dept making this much more difficult. It’s made work harder for branches and is confusing for members. Working with members while they get on their feet has become much more difficult.

DeleteNumbers and risk don’t just disappear. They simply move somewhere else. Where did they move to in each year?

ReplyDeleteLast couple of years, part of the additional risk exposure unnecessarily taken on by SECU is those out-of-state commercial loan investments - also underwater by the way.

ReplyDeleteOver $5 billion by the way.

DeleteI have to ask myself, why would these folks want to work at a non-profit organization run by the member/owners? I mean what 'really' is in it for them? Is it to hit us over the head with their philosophy of 'banking" until I say uncle? I mean they obviously don't like the thought of helping ALL members ...

ReplyDeleteRight, because Only A paper members are important to them ... the rest of us are just used to fund 'their' low interest rate.

DeleteThe extra $200 dollars a month I pay in interest can help them "Show a profit"! BTW, Who they showing this profit to?

I’d love to see that commenter from the last post refute this.

ReplyDeleteI say the difference is more about centralized collections than it is risk based pricing.

ReplyDeleteYou're right because those record profits were earned under the "same rate for all" model: RBL wasn't started until @ 6 months ago.

DeleteFolks say the centralized collection snafu implemented by Loan Administration caused delinquencies and losses to soar - and the loss ratio seems to indicate that is true. Same folks say the related loss was over $100 million, is that true?

Of course, the "Credit Union" doesn't pay for those losses; it comes out of the pockets of the members- that's right, you, me and 2.5 million other North Caolinians. members

Who pays for the losses for D and E paper loan?

Delete"Who pays for the losses for D and E paper loan?"

DeleteThe same members that pay for the losses of A, B, and C ... What you think they aren't capable of falling through the cracks? Life has a way of evening things out ...

At 1:02PM - Same folks who pay for management snafus, incoherent business decisions, and soaring operation costs.

DeleteGot it. Credit unions can operate on a loss.

ReplyDeleteThat's right and you don't have to look too far to prove that's true.

DeleteLet’s operate on a loss. Said no one ever.

DeleteI would think strategically operating for a loss would be frowned upon by members and regulators. So if you’re not strategically operating for a loss, then you’re strategically operating for a _______.

DeleteWell, strategically over 85 years the Board and management figured out how to run SECU without a loss - never missed in any quarter, in any year.. So, although you may not understand how to do that, many others do - perhaps you should listen ... and learn.

DeleteFinance isn't brain surgery, but it does require a basic understanding of arithmetic (y'know , 1+

+1 = 2!)... so with "real numbers" there are not just two options - profit or loss! There is a third option called "breakeven"...also known as "not for profit"!

" +, -, or zero"....will you ever understand? This is getting embarrassing...

Does it matter the extent to which a credit union “turns a profit” as long as any profit earned, no matter how large or how small, is returned to the members?

ReplyDeleteThat's right and up to $587 million was withheld from (not "returned" to) the SECU membership last year without justification. The "Credit Union" (whoever that is!?) made "record profits", while the SECU members suffered an unnecessary $587 million loss! Why was that done?

DeleteHappy Veterans Day to all the veterans out there. Thank you for your service.

ReplyDeleteWhat have they done with a BILLION dollars over the past two years? The record breaking BILLION that was somehow achieved without race based lending.

ReplyDeletehttps://www.secujustasking.com/2023_10_31_archive.html

None of it went to “A Paper” savers.

There are more important things to do than save members money like posting on LinkedIn. That's what's important these days correct? Or did that stop when Hayes left but we didn't get a memo about?

ReplyDeleteThey don’t want homegrown lending staff. They want AI and only people out of the metropolitan areas to work for them.

ReplyDeleteall by design .... the invisible forces ...

Delete... but the invisible is becoming visible to those who can discern the truth from the lies ...

Delete'They' want to control ... EVERYTHING!!!

'Someone' has hatched a plan to take over the CU and it's wealth regulating most members to a life of servitude to their 'rulers'.

ReplyDeleteBTW, does SECU still hire veterans or just high priced executives from other corporations?

ReplyDeleteThey need our support ... jus sayin ...

Of course that's asking a lot from these people who are only concerned with their A paper 'clients'!

DeleteThey have no clue .... they need to thank their lucky stars ...

fierce wolves are among us (even on the blog) and they will NOT spare the flock ... these folks are cunning, clever and ruthless ... they won't give up until they destroy everything SECU stands for ...

ReplyDeleteStand up and be counted, we have some more that have betrayed our trust and must be voted out!

Their view of the member/owner is based on an elitist mindset.

DeleteMemo to Board :

ReplyDeleteVoters fire entire local government - "“This is something Americans all across the country almost fantasize about, booting out their local government if they don’t like them and they’re not getting the job done,”"

Sincerely,

The Member/Owners of SECU

https://www.frontline.news/post/voters-fire-entire-local-government-over-support-for-ccp-linked-company