Another real-life story on risk-based lending…

"I have been a member and supporter of the credit union for over 30 years. My daughter has had credit since she graduated high school. She will be 28 next month! So a 10 year history! Her credit score is currently over 700+. She has never

had a late payment. She went to get a truck loan at SECU this week.

She didn’t

get the lowest rate. The loan officer or whatever they are called now, told her she missed the A-paper rate by just a little bit! Rates must’ve changed

recently because when she first started shopping for a truck the lowest

72 month rate was 6.25% and she was charged 7% (which is actually what

the current 72 month used car rate is now showing on the website)."

"I told

her to ask why she wasn’t getting the best rate and she was told the

above - "Sorry, you just missed!" She doesn’t own a home and just recently paid off two loans at Local Government CU

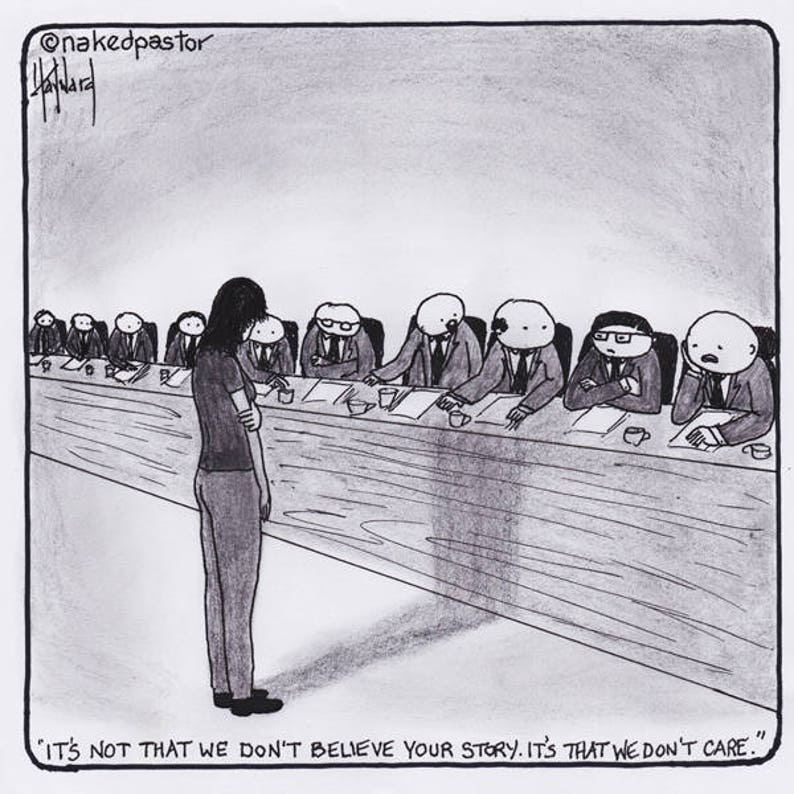

that probably hadn’t had time to increase her current credit score. Just a timing issue it appears, but SECU doesn't seem to care. Without

risk-based lending she would have gotten the best rate that SECU OFFERED!"

✅ And no, the loan officer didn't suggest that I cosign the loan to get her the best rate, like CEO Brady did with her kid. Wouldn't that qualify as discrimination?

"Sorry just my rant for today! "

.... you've got to be "kidding"! ... those "We Are's" continue to work their magic on member support ....