.

.

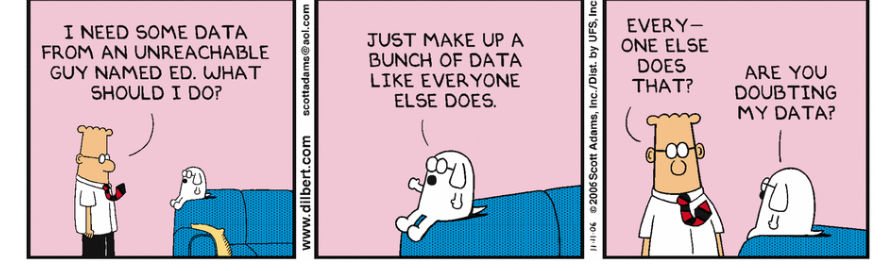

.. refer to the comments in the 6/27/2024 post [here's the link], if you want to see how this "Ed story" unfolds.

😎 Well, the "2:13pm/3:16pm commenter" is back! Still squirming frantically - trying to avoid "the light".

❇"some follow up to @6:27."

"1) Yes, SECU grew. Strongly? Compared to what? It's been shown not to have grown as fast as the local market."

As Cool Hand Luke was told: "What we have here is a failure to communicate."

The core problem may be that our "2:13/3:16 commenter" is simply of

the classic persona-types best described by the axiom: "Can't see the

forest for the trees."

So, "2:13/3:16 commenter": "Compared to what?" The bigger

picture? SECU, as you know, is the second largest CU in the US at @ $50

billion in assets - give or take a $5 billion "prop up" loan from the Fed.

(NavyFed in Virginia is by far the largest).

If CU size and

growth are related to population, etc as our commenter opines, then lets

fact-check that statement with a little broader and more fairly balanced vision.

North Carolina is the 9th most populous state in the US and at $50 billion+-, SECU is by far the largest CU in the State.

✅ Here's a list of the 10 most populous states in the US with the asset size of the largest CU in each state:

1. California - $29 billion

2. Texas - $18 billion

3. Florida - $16 billion

4. New York - $12 billion

5. Pennsylvania - $8 billion

6. Illinois - $19 billion

7. Ohio - $8 billion

8. Georgia - $10 billion

9. North Carolina - $50 billion

10. Michigan - $12 billion

... why is SECU so far ahead in terms of size, if population is the

key? (In case you're wondering, SC - $5 billion, Tn - $8 billion). Clearly something unique has been happening in North Carolina!

✅ Something doesn't "add up", does it? And that's the concern about the escalating lending losses and

delinquency at SECU. Those soaring costs "are adding up" at the expense

of the SECU membership. Look closely, isn't SECU a unicorn?

Was a unicorn! currently it is transforming into a donkey? zebra?

ReplyDeleteIf SECU is so great why aren't other credit unions trying to copy the model?

ReplyDeleteGroup think? Greed? Industry standard?

DeletePerhaps they don't believe in unicorns, which is understandable; or don't believe in people which is unforgivable.

DeleteSECU maintained the cooperative principles. Many credit unions did. Gradually over time, SECU was the only one left standing that adhered to members first and all members are equal. No RBL! Members were actively involved in the credit union through the loan review committee and active service on a fully functioning advisory board. All that changed when the SECU Board hired Jim Hayes to implement their major policy changes to become the current "industry standard" and to expand into other states--to lose the focus on North Carolina consumers--and push for business services. SECU remained a proven successful business model until 3 years ago. The current Leighduhship badly wants to discredit the 85 year success story however it can. The numbers say this current board can not even successfully implement Industry Standard, much less run a credit union that provides superior loan and saving rates to all members. Poor service, miserable employees and lack of transparency have been other by products of the move to industry standard under the current "regime"! Members do not want Industry Standard at OUR SECU!

Delete