Carolinas' Credit Union League CEO Dan Schline is lobbying for passage of H. 410, primarily on behalf of SECU, which has announced intentions of moving toward an open - anyone can join - public membership. CEO Schline pooh-poohs those intentions, although SECU's now famous "Fireside Chat" videos document those intentions clearly.

Mr. Schline claims that open membership for state-chartered credit unions - which passage of H. 410 would enable - is really about serving North Carolinians stranded in "financial deserts" without access to financial service. Mr. Schline and crew have even come up with a map showing those North Carolina deserts (see below - the "red" shaded areas).

You will note that the definition of a "desert" is no bank branch within 10 miles. Of course, the CCUL leader does seem to overlook the presence of a gazillion ATMs, not to mention that "all digital, no branches" future vision that some - you know who - credit unions are espousing.

But lets not argue about reality, we need to look at why CCUL and Mr. Schline are having a growing "incredibility" problem over at the Legislature with H. 410. Here's the classic example. Look at the North Carolina map and focus on the "red shaded financial desert" west of Asheville - see the second map to have a closer view.

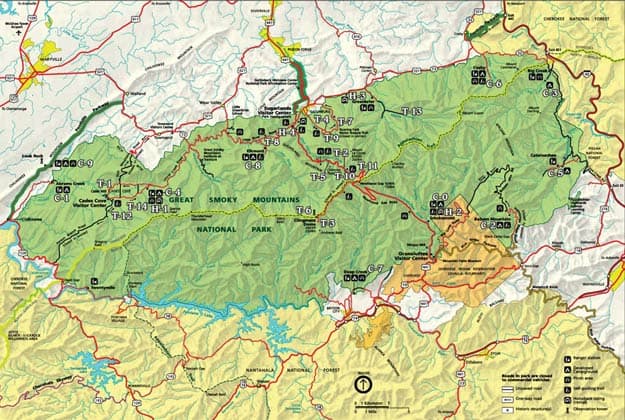

Now look at the last map and visually compare it to the west of Asheville "financial desert" map. See the similarity? Do you know what that last map is?

It's a map of the Smoky Mountains National Park. I assume that Mr. Schline is slyly proposing that open membership should include financially strapped bears ...

Some would simply say that this sort of specious, "false deserts" lobbying is....well... preposterous!

Not only preposterous, but also unbearable!

Looks like they’ve labeled the Green Swamp of SE NC as a bank desert as well. The Venus fly traps are suffering from lack of facilities.

ReplyDeleteDon't forget Alligator River National Wildlife and Mattamuskeet National Widlife. This map is a joke. Nothing but swamps, farm land, game land and parks. Big reason why no banks are in the area!

DeleteOn Thursday, I am counting on our State Legislature's elected officials from every county in North Carolina who will be listening and voting on H.410 being fully aware of the fact: these financially strapped bears are not the ones who voted them into office, but we the people of NC! Many of whom are SECU Members who are totally against the passing of H.410.

ReplyDeleteSchline, Hayes and Ayres missed the mark in using financial deserts as a way to get their freedom to allow credit union charter changes. This term financial deserts is most associated with the term inability to receive "branch service." Hayes and Ayers for the past 18 months has done nothing but diminish the importance of branch service, in fact crippling many of SECU branches statewide with their new ideas and new direction.

Neither of you are interested in the well being of SECU Members, you have made that perfectly clear by changing lending policies, halting services we as members have come to count on from SECU staff and short staffing our branches we go to for help. I am one fed up long time SECU member and I know there are thousands who will join me with hopes in watching your best laid plans fail next week. H.410 is not about helping the people of North Carolina.

It's definitely not about financial dessert. It's about 💰💰💰💰💰. SECU CEO and BOD wants that business lending, business accounts, business policy.

DeleteSECU has been taken over by folks without a fiber of credit union knowledge or philosophy. Credit Unions are about Members, improving individuals' financial lives and promoting Thrift - a word this group clearly does not understand or we wouldn't be seeing a 2 Billion dollars decrease in SECU assets. Leave the business accounts and the business lending in their rightful place with our local banks. This CEO, Board and Admin are way out of line in their duties to serve SECU Members across North Carolina.

DeleteSorry, had a Jimmy Hayes moment. I mean to say desert or dessert.

DeleteThey lost creditability with a lot of people when they lost 2 Billion dollars last year…. Why and how

ReplyDeleteSome of that from a TV commercial that they pulled last minute but still had to pay for

DeleteI am very confused why assets diminished that much when all of the real estate value has increased substantially!! Extremely worrisome 🥺

Deleteand now they want to sell some of that valuable real estate to enhance their poorly showing bottom line.

Delete25 year Member here who uses SECU as my primary Financial Institution. We, as Member Owners need to see exactly where the dollars have gone over the past 18 months. Records show for 85 years SECU has gained in assets every single year since 1947. And now we are in decline!

DeleteSince This Board brought Hayes into our Credit Union, we members have experienced first hand the decline in products and services under his leadership. Now a 2 billion dollar decline in assets. We demand to see a specific line item detail as to where this loss has occurred. Not buying into their usual excuse - technology changes. As owners we should have access to all these new hire salaries, consultant charges, employee expense accounts, board expense accounts, costs of Gym on Salisbury Street and all other frivolous spending. We are not doing business with a commercial bank, we are a credit union. Our deposit rates are down, our products and services are down - but you are giving us members risk based pricing on auto loans. SECU's risk is not in the loans being made to us as members but in the Board, CEO Hayes and his Administration who are spending the members hard earned money wastefully without benefit to SECU's membership. We are the owners and we don't intend to be the losers. Awaiting a clear report every member can read and understand as to how you are spending Our Money.

And as for H.410, this is yet another crooked way of removing the true owners of SECU.

Several times I have seen mention of a TV commercial which was pulled but still had to be paid for. As a member owner I would like to know what my credit union money was wasted on there.

DeleteIf you email the board asking for line items as to where this 2 million dollars was spent, are they obligated to tell you?

DeleteYes they are obligated to answer to the membership. Send those emails. Employees can't do this, their livelihoods have been threatened. We Members need to start taking ownership and demand answers, they don't own us- we own them. The more conversations we can have with other members, the better. Talk it to our coworkers, make them aware of what has taken place at SECU the past 18 months. Remind them of what LGFCU is losing in March 2024, this could be happening to SECU members just as easily. This CEO Hayes has to be removed and the Board needs to start listening to their members and employees. Their disregard for SEANC's request to halt the recent lending change was enough for me.

DeleteTwo Billion dollars instead of Two Million in ref to 6:26 pm post above. Don't let them get away with just explaining a 2 million dollar loss. They are burning thru our money like wildfire.

Delete***Very important to note, Hayes came to SECU from Andrews Federal Credit Union with assets of 2.2 Billion at the time of his leaving. In less than 18 months, he and the Board have wasted the total worth of his previous credit union. A question for us as Members, what has that given us? Lower deposit rates, higher loan rates, decline in services offered and a very unhappy and concerned group of long term quality employees across our state. The most important question, can SECU afford to keep him?

DeleteThere needs to be an investigation on Mr. Hayes. As a member and public educator of Durham Public schools…I am very concerned at what’s going on at the Credit Union. I have a couple of relatives that work at SECU currently and they are very concerned about their future at SECU.

ReplyDeleteWe are concerned. We all heard that one of the first things he said is SECU has too many employees. Heard that back in October 2021.

DeleteAnd that executive comp was below industry.

DeleteBut apparently not for internal departments. That headcount has exploded. And that's why the members are paying the price because their branches are short staffed while Haze tries to repair his bottom line numbers by reducing staff in the branches. What does he care? He was never sold on the branch network from day one.

DeleteYes, he said it. And what's his remedy, send more people to WFH (whatever they do in an 8 hour workday), Specialize(no answering of ringing phones though)and further decrease the member facing employees taking care of the members. Which is why so many members are asking what is going on when they enter their branches?

DeleteTalking about a royal mess, Hayes, Exec team, Loan Admin and FAS has destroyed SECU'S member facing service. But they brought on a great marketing team at a huge cost -- For years SECU's great marketing team has always been and will always be their member facing employees.

SECU staff statewide consists primarily of many long term employees who love their jobs and love serving their members. It is this group who are the most at risk of losing their jobs, they are not wanted by this Administration or Board. The most recent meeting in Greensboro with the SVPs and VPs proved that, either get on board or risk your career.

DeleteNot fair to the Members, Not Fair to the dedicated SECU staff who have helped to build the credit union.

I wouldn't say loan administration and FAS destroyed anything. They only doing what Jimmy is telling them. Remember, shit rolls down hill.

DeleteAfter Haze and Brady you can't blame employees for doing what they are told to do in order to keep their jobs - they have families to provide for. This Administration is vindictive, dissenting opinions are not allowed. Anyone that disagrees with them is the enemy and they want you gone. Terrible work environment, particularly in the branches where employees are treated like second class citizens.

DeletePlease know that many internal departments and employees are feeling the same sting as so many branches and branch staff are feeling. We are also short staffed and doing all we can to keep our heads above water and off the chopping block. Many of us have been told to make changes or bring in partners that DO NOT benefit SECU or her members but when questions are asked, we are told we are “resistant to change.” Not true but the truth doesn’t matter to the current BOD, CEO, or exec team. We all want our credit union back!

DeleteNew administration has a very simple message, get on board to our Hazey vision or find a new job. They said this at the Greensboro meeting and the town hall Friday, at least 10 times.

DeleteI agree with the sentiments above. Let's not make this into a branch vs operations p*ssing contest. Many of us folks "in Raleigh" detest the changes as much as anyone else. Many of us started our careers in branches. Many of us made a great sacrifice to move away from our families and our hometowns. Now we are also wondering what the sacrifice was for under the current leadership. We must stay focused and not start any infighting.

DeleteIn total agreement with the statement above. We all need our coworkers - we need one another for support and encouragement. We owe it to our members to continue giving them our best and it takes all of us working together. Whether it be branch, mss, or operations employees with a few years of service prior to Hayes and his Executive team, the decline is there for us all to see. We are all devastated by what they are doing to our members and our workplace. They call it change, we call it making SECU unrecognizable. We can't fight the fight openly for fear of losing our jobs, but we have family and friends who are members. We talk about FB posts, Instagrams, books, movies and blogs with them all the time. Their voices can't be silenced by the fear of losing their jobs. If only 5000 employees shared with 4 friends or family members who shared with others...imagine how quickly all across the state folks would know exactly what's taking place down at the credit union. None of us asked to be put in this position, it was forced upon us by a 6 to 5 vote from 11 individuals who were tasked with doing what is best for SECU and the Members

Delete100% agree^. Everything can be done on the internet. Create anonymous accounts and take it to Facebook where the public can see the outcry publicly.

Delete‘Branch vs operations’….well would both sides walk off the job for a few days for each other if it meant the BOD might wake up? Doubtful. It is hard to see the level playing field from the branch as we have witnessed so much emphasis on title, structure, and centralized authority. We also see what the branch of the future looks like in just 18 months. The branch sees the need for change to save what we care about. Certainly hope we can all see eye to eye someday. But hard to forget the last CLO commenting on how error prone the branches were. Well, not ours any longer but I sure don’t see any error rates published now.

DeleteYeah, that Chief Lending Officer finished his career on a sour note with most employees. Pretty much sold out SECU's dedicated hard working lenders for his own short moment in the spotlight.

DeleteHe had always wanted RBL. why did he leave so abruptly after he got his way? What's the inside scoop on that?

DeletePretty sure he was already on his way out. I believe SW was promoted to Deputy Cheif LO while ML was CEO for the purpose of leading Loan Admin after his retirement.

DeleteReplying to the post made at 12:44. Sorry but we have no control over what West Coast Hazey IPA and Board are doing to the branch network. I see and understand the struggle branch staff are going through. We have plenty of problems of our own that you'll never hear about.

DeleteThat is why I say stay focused on the decision makers and not your brothers and sisters who are just trying to take care of our families. In the end, we all just want to serve our Members the best that we can. No infighting!

Why is Leigh Brady coming to western counties next week?

ReplyDeleteBrady is touring the State to make sure SVP’s get the message about “being on board or taking the walk” and passing that on to the VP’s.

Deletewhy doesn't Ms. Brady take her own advice and take a walk?

DeleteHmm, seems like the 'Hunger Games' plot. District 12 (which is supposed to be Appalachia and the films were actually filmed around Asheville) gets out of line and gets a beat down from 'The Capitol', i.e. the ruling class.

DeleteShe won't take a walk. Jim Hayes is ducking everything, Leigh is putting her name on all the memos etc. She thinks the board will fire Hayes and put her in since she really is ruinning the place

Deleteoops meant running

DeleteBeing a very interested member and curious as to what has taken place at my SECU and not understanding why so many changes. I've done some reading and found several interesting things. Appears if CEO Hayes is so interested in saving financial deserts, he needs to return to California. SECU and North Carolina didn't have any of these problems till this Board put him in power. And now he has gone to the Legislature trying to get his way in NC, the Great Smokies- a financial desert? More than ridiculous.

ReplyDelete"Where Are Banking Deserts Located?

The majority of banking deserts are located in rural, desert areas including large parts of the Southwest. For instance, there is a concentration of banking deserts in southeastern California, Arizona, and Nevada."

(Reference from Investopedia Rebecca Lake Updated June 04, 2022.)

As an employee, I'm glad to see this blog is reaching members. Please spread the word about West Coast Hazey IPA. We have 2.6 million members compared to 7, 000 employees. This is YOUR credit union!

DeleteAs a long term employee I can tell you declining assets aren’t because branch employees are busting their butts. We used to be the best in deposit and lending rates and now nothing separates us from industry standard. We’re waiting for reports but in my area the first month of “Race Based Lending” has been a disaster. We’ll see what the numbers show.

ReplyDeleteLike stated in previous comments I’ve heard Gym Haze thinks we have too many employees (particularly branch employees) but internal departments have been created and exploded with employees. There were approximately 570 VP, SVP, AVP, EVP and whatever other titles that have been created in Greensboro. With approximately 280 branches you can clearly see the number of new employees hired. As time goes on it becomes more clear this is the opinion or work of Cornerstone. How much of the decline in assets has gone to Cornerstone?

I’m still laughing about “financially strapped bears”.

What is Cornerstone? Is this the same company based out of Santa Monica California? If so, what are they doing involved in our credit union? Unclear what they have to with my credit union account in North Carolina.

DeleteYes that is the same company. Cornerstone is “guiding” Gym as a consultant, conducting staffing studies when they clearly understand nothing about us, moving us towards industry standard. Really taking us for all they can.

DeletePlease tell us who, what is Cornerstone? I am a member not employee reading this blog and the comments. I keep seeing Cornerstone mentioned. I understand they are some sort of consultants that have been hired, but what is the job they have been hired for? What do they do?

DeleteThey do the CEO's job.

DeleteNorth Carolina is as foreign to Jim Hayes as the Amazon Jungle is…He doesn’t know anything about these towns. He know doesn’t know NAFTA ripped jobs away from several rural towns in NC and a lot of local economies were devastated. We need SECU branches and contact centers out in these communities. If he truly cared about these communities, he wouldn’t have centralized everything in Raleigh and look to hiring out of state employees. Everything he has done has been a slap in the face to the North Carolina working class. Let’s charge higher interest rates, let’s pull jobs away from local economies, yeah that’s how we help North Carolina! The gig is up…

ReplyDeleteRemember the old SECU, the one they want us to forget. The organization who tried to shop North Carolina FIRST for products and services and most importantly employees. Now SECU Board of Directors from the great state of North Carolina, do you see the problem you created by not hiring from within. You haven't just failed SECU and Members, you created a big hit on the North Carolina economy. Would be willing to bet the majority of that 2 billion left our state.

Deletenot a problem for the board. Things are going according to their plan. There is a pot of gold for them at the end of this. big payouts when they go regional and get the "eligible to be bought by bank" clause put back in to the House Bill.

DeleteWhat is Smokey the Bear's credit score?

ReplyDeleteSmokey's credit is 750, he paid Key Credit Repair, LLC to get that number up before applying. Again, credit scores are not the way to decision loans and certainly should not be used to determine interest rates. But that's ok, SECU's March auto loan numbers will tell the story, if they are reported accurately.

DeleteExpect the spin cycle. Would not be surprised if the programming that auto-approves loans was tweaked to get loan approvals up.

Delete"Poor Leigh" isn't savvy enough to know she's the pigeon in this mess

ReplyDelete