Oxymoron - n, a combination of contradictory or incongruous words. from the Greek "oxus" (sharp) + "moros" (foolish).

Please choose an example from the New/New SECU:

1) "Confidential" Employee Survey

口 Pretty Ugly?

2) SECU "Culture" Department

ロ Awfully Good?

3) A "no formal" merger proposal proposal

口 Virtual Reality?

4) SECU "Strategic" Plan

口 Grow Small, Unlimited Budget?

5) Centralized "Collections"

口 Stupid Genius ?

6) New "democratic" board election procedures

口 True Fiction ?

7) Open "Membership"

口 Small Crowd ?

8) " H. 410"

口 Dan Schline?

9) SECU Business "Ethics"

口 Genuine Imitation?

10) "This" SECU Board

口 Crash landing?

... does there appear to be more moros than oxus in the works at SECU these days?

... SILENT SCREAM?

So goes the culture, so goes the company.

ReplyDeleteStage a state-wide walk out. This has to stop now.

ReplyDeleteI’d like to know HOW I can do something. I am an SECU “legacy” employee who is tired of the BS. But I am not sure how to mobilize and stand up without risking my neck. How do we coordinate? Help us, Blaine!

ReplyDeleteYes we need big help! I can’t afford to lose my job.

DeleteThis!! What exactly CAN we do, as employees, to stop this mess?? We need help and guidance!

DeleteMe too! I echo this sentiment.

ReplyDelete11) No technology updates since 1983

ReplyDelete"Clearly Misunderstood"

I think we need to get a Facebook page and post information there, then have "friends" share the information. I hate to put out bad publicity, but getting more eyes and questions raised by the general membership is the only way to truely get the BODs attention. I hate we're being put in a situation where we have to speak the negative truth of what is going on, but it's for the long-term good for SECU and the membership. Please Jim Hayes, resign and start over some where else and don't put all of the employees in this situation any longer. Trust continues to be eroded and is too far past to be repaired.

ReplyDeleteALL the board members just gave him a vote of confidence recently .... they're all in it together.

DeleteThis Board's vote of confidence is about as worthless as their decision making. They're not thinking about us members so there has to be some personal benefits for themselves hidden in all this trash. Supposedly these people are educated? No one ruins their reputation for nothing. It's no wonder their employees are so upset, they have trashed all that was good at our credit union.

DeleteBoard is in on this at all levels. Right from the start. Why else would MetLife, an insurance company, handle our HSAs? Fidelity has one of the best HSA accounts. Our 401K is ALREADY with Fidelity and all SECU had to do was ‘reach out’ to their representative. Instead they did a big song and dance trying to justify their MetLife choice.

DeleteDecentralization? For all his big talks and flashy emails and advice on books to read looking in a mirror, I guess Hayes hasn’t been taught the basics in leadership. Culture of Leadership at ALL Levels served SECU well for 85 years and that’s what made a small local credit union in NC become the 2nd largest credit union in the country.

So the recommendation to Hayes is to read this article “WITH AN OPEN MIND” “FROM A POINT OF CURIOSITY” and “STAY ABOVE THE LINE”: https://www.entrepreneur.com/growing-a-business/how-a-culture-of-leadership-at-all-levels-will-help-your/271411

I hate to derail the topic of the post, but since this blog has become the only (or at least the easiest to find) centralized location for myself and seemingly many others to openly discuss/learn what is going on with our credit union, I was hoping to post a few questions that someone could help shed a light on hopefully.

ReplyDeleteI've read comments regarding trips to Duck, NC as well as Hawaii. Are these true? Is this verified factual information? If so, where could I find more information about these events?

I read a comment yesterday about an executive gym?? Is this a real thing? Someone else asked but the original commentor has not responded.

I agree with basically all of the sentiment here by both Mr. Blaine and most of the commentors here. Sometimes though while reading through the comments, I feel very out of the loop about references being made. We should try to do better about explaining things in a less esoteric way. There are definitely members and many more employees than actually post here that are reading this blog and its comments. We need to save our credit union. What is happening is a travesty

Yes, it is factual. The trip executive management and the Board recently took to a high end resort in Duck was a Board "planning session".

DeleteLast year Hayes and at least one Board member (Chris Ayers for sure, maybe more) attended a "conference" in Hawaii and at last check were going again this year.

There is a gym in the basement of the Salisbury Street 12 story building. Before being remodeled it was previously used to host FatCat kids visiting downtown Raleigh from schools across the state. The gym is not available to all SECU employees. Perhaps just employees at Salisbury Street?

You are right, as more members become aware of the Blog employees should try to explain things more fully. Members are the key to making a change, they must get involved.

The gym is true. Though it is open to all staff who work in the Raleigh-Salisbury St. building. Those who don't work at that location are not allowed to use it.

Deletehttp://www.secujustasking.com/2023/03/secu-new-culture-new-direction-gym-haze.html

DeleteDuck - planning retreat for Board. Common knowledge. They’ve been there in the past as well. Nothing new. They refurbished the Fat Cat lounge at HQ and it’s now a private gym.

DeleteThis is a rumor. I repeat THIS IS ONLY A RUMOR. However, someone who I trust to be telling me the truth (they may have been misinformed thogh) told me that SUPPOSEDLY secu has recently sold the property where the Raleigh call center is located. IF TRUE, i wonder if that would be a sign of the work from home nature of those jobs or a sign of something worse...

ReplyDeleteWhat about the rumor that IS is in over their heads and the layoffs are coming .....?

DeleteYou mean the operations center on Six Forks Rd? That's very valuable real estate in a desirable area. It would be stupidly short sighted to sell it; better to rent it out to another company and make big money.

DeleteSo yeah, they probably sold it, lol.

"...rumor that IS is in over their heads and the layoffs are coming" Wow, if that's true, it's unlikely the people that got them into a mess will know how to get them out of the mess. Likely, they will only make things worse.

DeleteWhat is “IS”?

DeleteNot sure if the fall under this portion of the Federal Credit Union Act of not but it prohibits a credit union from owning a property for more than a few years without occupying a majority of it. In other words not owning and renting it out.

DeleteIS stood for “Information Services”. The new CITO changed the department name to IT “Information Technology”

DeleteLet the Hunger Games begin .....

ReplyDeleteMembers are starting to ask questions, a lot of people I know are being honest with them and telling them.. I’m not going to lie or down play it… they deserve to know… SECU’s current money hungry mindset, open membership and vast spending habits…. I told a member today about CEO Hayes past record… and what happened to those banks

ReplyDeleteI FOUND OUT TODAY that to change my car loan due date from the 15th to the 1st you have to refinance it… this is a SCAM!!! My rate was going to be 7% I’m currently at 3.95% ! I’m not happy!!!!! JUST TO CHANGE MY DUE DATE! I’m grateful she told me about what is happening and to find this. Sincerely, a member of 20 years!!!!!!!!

ReplyDeleteYour promissory note is a signed legal contract with an agreed due date chosen by you. Changing the due date would require a new contract- hence a refinance. Rates on auto loans have gone up in general the last 2 years so there is a slim chance you’d get 3.5% anywhere. This is not particular to auto loans.

DeleteYou do not have to refinance to change your due date. I am sorry that the employee provided you incorrect information.

DeleteSame thing happened to my brother, thankful for the branch employee who cared enough to explain and stopped him from making a big mistake! What's up with not being able to trust the credit union now?

DeleteIf you are not extending the term by multiple months, then it will not need to be refinanced. This is just a billing schedule change. Sorry for the inconvenience, but she unfortunately gave incorrect information. You should go back to the branch or call in. Ask for a manager to assist you if needed.

DeleteYou don’t have to refinance unless your payment frequency(monthly to biweekly, weekly to month)is changing. Due dates can be changed without a refi.

DeleteYep, that's a scam. We're run by a bunch of scam artists now.

DeleteGood for that employee sharing the situation with members! That's how we used to operate -- honestly.

Guys you need to check on keying a billing schedule change. Changing due dates on a Closed End/Auto Loan is not correct. Refinance is the correct procedure. Not saying I agree, but like stated above it is changing the Promissory Note. I used to key these changes all the time but there is a memo stating this is not allowed.

DeleteAre we confirming that SECU doesn't know what it is doing or what?

DeleteHave Momma Brady co-sign

DeleteI questioned this today with Loan Servicing and was informed in order to simply change your due date on a loan, no frequency change, you do in fact have to refinance? That is bizarre to me

DeleteI also was told the new policy is you have to refinance to change a due date

DeleteShouldn't SECU post its loan policies on the website so members will know the rules even if staff obviously doesn't?

DeleteIt seems like if it made it easier for the member to pay us back each month, then just allow a due date change. But instead they make it harder for the member… gotta requalify, income, pull a credit report, LTV issues, higher interest rate… just to change a due date….? Most banks allow a date change

DeleteHalf of auto power loans have the wrong start date, it defaults for 30 days after the closing date. And then members request a change and told nope, gotta refinance

DeleteSomebody would have to lead and actually know what they are doing to post the information. SECU doesn't do that anymore.

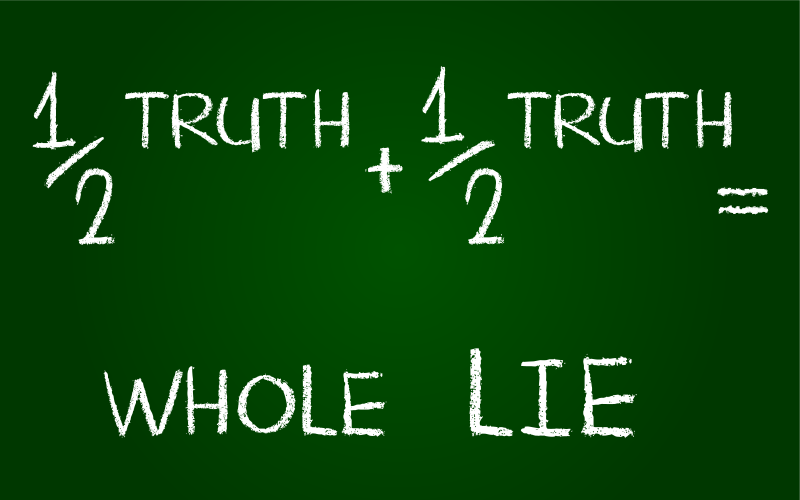

Deleteall part of the New/New bait and switch. The New/New likes to keep things secret, "we know but you don't!"

DeleteUnfortunately this confusion seems to be a byproduct (and prime example) of how too many changes occurring too rapidly can have negative implications. Microcosm of SECU as a whole. Employees can't keep up and ultimately member service suffers.

DeleteI wonder if California native Jim Hayes knows what North Carolina's state motto is?

ReplyDeleteAh heck, who am I kidding. Even if you showed him the words, he'd never be able to understand what they truly mean.

A little late to this blog but trying to catch up over the past few weeks. Took a look at the SECU website last night primarily to read about just exactly who sits on our SECU Board. Among the many articles on the site, Glaring at me was a California Collection Policy? dated January 1, 2023. Can someone explain? Last time I checked we are North Carolina or has this CEO and Board changed that? With all the controversy surrounding this CEO and knowing his California issues, very troubling for a member to see. At this point me & many of my coworkers are questioning everything going on at our credit union. Don't like it, never had these worries before.

ReplyDeleteMy guess is if a member moves to CA and has a loan with us, we have to follow CA specific laws when collecting that loan.

DeleteEmployees are also members. Hayes thinking of moving back to CA after taking out loans? Hmm... 🤔

DeleteSECU, the new Wells Fargo, what could go wrong for the members?

ReplyDeleteLooks like little Jimmy haze and company are tanking the systems today. Nothing is working.

ReplyDelete