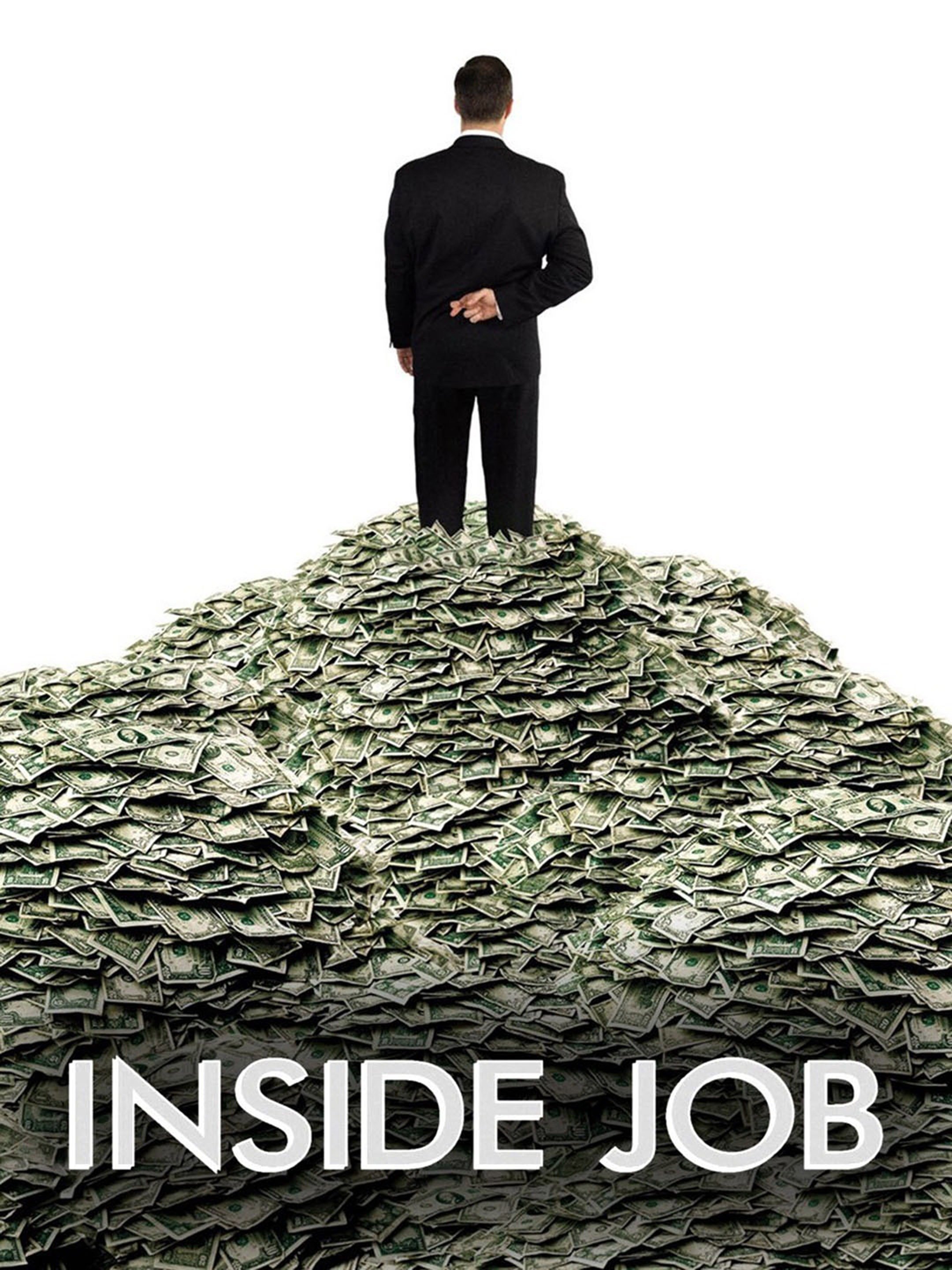

😣😣😣 I truly apologize for the length of this post, but hope you will knuckle down and plod through it. This one will give you the "OMG" not again panic which you witnessed in the "Inside Job" documentary.

Please get some coffee, go slow. Thanks for your patience as an SECU member...it is important!

🔆 The Q&A below was sent from the "happy campers" above to all staff, advisory boards, and members @ June 1, 2023 - a week before "this Board" received a "take this job and shove it" note from the CEO:

"❓In evaluating CEO candidates, was the Board of Directors aware of Jim Hayes's time as CFO at Wescorp

when it went into receivership? "

"✔ Yes. The Board of Directors retained Russell Reynolds to conduct a national candidate search and extensively

investigate all CEO candidates, including Jim Hayes. 1) The investigation included conversations with regulators

and others with first-hand knowledge of the Wescorp receivership and related litigation. Through those

conversations, 2) it was clear that not only did Mr. Hayes have nothing to do with the issues that put Wescorp into

receivership, 3) the National Credit Union Administration (NCUA) retained him as the CFO because they trusted

him to stabilize the situation and wind down operations in an orderly manner. 4) The Board concluded that the

same leadership qualities that NCUA recognized 5) when it asked Mr. Hayes to navigate Wescorp through

receivership as CFO, stood as concrete examples of an SECU leader "Doing the Right Thing," 6) particularly in the

face of adversity."

🔆 Let's parse this one too...

✅ 1) It would be interesting to know who those "conversations" at NCUA were with - who had "first-hand" knowledge of Wescorp (only a handful of suspects exist, promise!)? If you a) watched "Inside Job" about 2008, b) read the NCUA Inspector General's (OIG) own internal condemnation of the regulatory incompetency of the Office of Corporate Credit Unions (OCCU), and c) noted NCUA's forced removal of the suing credit unions from the Wescorp litigation - you might detect a strong whiff of "odeur d'skunk"

✅ 2) Believe the NCUA Office of the Inspector General (OIG) might also be interested in who at NCUA is endorsing CEO candidates for a major credit union like SECU. Not exactly what one would expect from an arm's length, impartial, independent regulator, is it? Suspect it is an outright violation of NCUA's Code of Conduct and agency ethical standards.

And, in his 10 years at Wescorp as an onsite examiner and Senior VP leader, Mr. Hayes had "nothing to do with the issues that put Wescorp into receivership"? [Am I the only person reading that statement who wants to run from the room screaming and yelling in outraged disbelief?]

✅ 3) It is beyond dispute that Mr. Hayes had @ a 10 year career at Wescorp, including @ 3 years as an onsite "capital markets specialist"examiner under OCCU from @ 2000-2003, then 6+ years in the "C-suite" at Wescorp . It is also beyond dispute that Wescorp CEO Bob Siravo hired Mr. Hayes as Wescorp CFO, not NCUA. Cynics believe he pleaded with his former buddies at NCUA to "hang around" as CFO after 6 years of mismanaging Wescorp's "ALM" into bankruptcy; because he wanted a shot at... remember that possible little $14 million "cash out" on the "benefit plan"? [... 'course you don't! Because you're going to read about "benefit plans" in tomorrow's post!]

As you watched on "Inside Job", greed and self-interest ran rampant everywhere else in 2008. Wescorp was obviously ripe too, with some "ethically flexible" senior leadership, weren't they.

✅ 4) Would simply hope that "this Board" would apologize now to the entire SECU membership for this lack of good judgment. And, then individually do what is well-mannered and necessary for the membership and long range integrity of SECU.

✅ 5) Any knowledgeable professional knows that Mr. Hayes wasn't chosen to "navigate Wescorp through receivership"... that job went to a gentleman named Phil Perkins, who was chosen as the new CEO - look it up.

✅ 6) Lastly, it comes as the sharpest of insults to the staff to see that "this Board" thought it needed a leader "qualified" in receivership and adversity "to stabilize the situation and wind down operations in an orderly manner" - at SECU? [Sorry have to leave the room again!]

😎 Okay, so now for the "Inside Job", conspiracy theorist paranoia, "coup de grace" ... you thought it couldn't get any worse, right?

✅ Who would you think the SECU Board CEO Search Committee might have "conversations" with at NCUA about their "best on the planet" CEO candidate?

Well, I can't say (now!) for sure, but one might consider talking with the person at NCUA who was the top regulator of SECU. ✅ Wouldn't you go to the top if you were seeking CEO candidate advice and guidance - why shoot lower?

✅ The NCUA federal regulatory group which supervises SECU is called the Office of National Examinations and Supervision (the "ONES"). The ONES is only involved with the supervision of credit unions with assets greater than $10 billion and - wait for this! - corporate credit unions! [..what a coincidence!]

✅ The director of the ONES is a gentleman named Mr. Scott Hunt - the chief federal regulator over SECU!.

✅ Here take a look at Mr. Hunt's LinkedIn profile, but before you do, note...

- 1) Mr. Hunt too was a "capital market specialist" examiner early in his NCUA career with his friend _______ [fill in the blank],

- 2) look at what Mr. Hunt was doing at NCUA in 2008 (Head of OCCU!) when Wescorp went down,

- 3) take a look at his primary "portfolio endorsement" [a person who modestly proclaims he is "highly skilled at this"] and then...

- 4) "connect the dots".

... "Insiders" didn't get fired, weren't held accountable, got off scott-free.

... "Insiders" didn't get fired, weren't held accountable, got off scott-free.

... and nothing seems to have changed, does it.

This BoD definitely has been up to no good. I thank God for you, Jim Blaine, for helping us navigate through this nightmare. Without you and this blog, we would be struggling to figure out this mess. “Why would this board do this”, question, rings through my mind. Honestly, the more I try and process where we are, the why, doesn’t matter. They DID and ARE trying to dismantle OUR members first, people helping people, send us your Mama, SECU. ALL OF THIS BOARD MUST GO!

ReplyDeleteIf This Board thought last year's Annual Meeting was tough, might want to look into a larger venue for 2023. Members want to ask some questions of these Board of Directors.

DeleteAmen to this! I’ve spent the last 18 months trying to figure out why we’re doing everything backwards all of a sudden and all at once. That is, when I had the time, in between the 1,100 emails welcoming new employees.

DeleteHow bout Carter Finley in Raleigh? biggest place I can think of...

DeleteBeing a long time member, I will be in attendance for that annual meeting. The BOD should go ahead and call an emergency meeting and answer for all of this chaos.

DeleteWouldn't be surprised if BOD decided to make 2023 annual meeting "virtual" this year and also not allow an open forum for new business. They are surely aware of the proverbial "sh$t storm that's headed their way come October and... unfortunately, I don't think they have the " cojunes" to face 1,000s of upset members!

DeleteA virtual meeting would only serve to make matters worse.

DeleteI know this isn’t an important detail, but of course Hayes got a new job at a credit union in Alexandria, VA where NCUA is headquartered 😂

ReplyDeleteAll organizations have some bad actors in their midst, NCUA is no different!

DeleteTake note Hayes and SDFCU’s former/retiring CEO appear to be well acquainted with one another. LinkedIn shows primarily interaction with Jim Hayes’ posts and very little with others. Jan Roche, retiring CEO of SDFCU was also at some point the Vice Chair on Filene’s advisory board. Jim Hayes is currently an advisory board member of Filene. In addition, it appears that SDFCU and Andrews Federal used to do much together including annual meetings, per Roche’s own LinkedIn comments. “People helping people” more like CEOs helping CEOs. Seems quite the good ol’ boys club at the top of the Credit Union world.

Deletewhere there's money to be had there's corruption!

DeleteIf Mr. Hayes was an average person, he would be in jail.

ReplyDeleteoff to fill up my thermos .... I'll be back ...

ReplyDeleteThis is beyond E'ffed up!

ReplyDelete(Excuse my outrage....no wait, on second thought don't excuse it at all!)

"... stood as concrete examples of an SECU leader "Doing the Right Thing," 6) particularly in the face of adversity." "

ReplyDeleteSo I didn't make it far before I spit out my coffee all over the keyboard!!!

"odeur d'skunk" is the best selling cologne/perfume for the "Industry Standard" folks ...

ReplyDeleteAbsolutely disgusting!! Is it called “sleeping your way to the top” if you’re a guy?

ReplyDelete"10 years at Wescorp as an onsite examiner and Senior VP leader ..." he knew all the internal workings of this place .... could this be an inside job? ... Naw of course not "they" say ...

ReplyDeletethis just stinks to high heaven ... this is the problem when nobody can be trusted to "Do the Right Thing" and now SECU's trust to it's members has been compromised with this BOD ... If something doesn't happen about all this (with a start of replacing 3 board members), SECU will just become another cash cow for these "elites" to party on their yachts! I think this board which is head up by Mr Ayers have strayed from their moorings ...

ReplyDeleteThis Board has done so much damage to SECU with their ineptitude with everything that they have touched. SECU has lost billions of $ due to our below market rates, we will have nearly $100 million in loan chargeoffs, employee morale is at its lowest and even worse is that they have turned their back on the membership. We've mentioned several areas where member service has declined but can we get some comments from our MSS employees on the failure of the MSS changes. I'm hearing from members that they are being told by the the new phone system that there are 200+ minute waits now. Abandonment rates are through the roof and employees are no longer being able to help assist with calls because OT has been banned. Add in the factor that branch employees can no longer help with call volume has made this whole system a disaster. We were told, by Gym Hayes, there would be some issues but after 6 weeks into this process you would think we would be making improvement not getting worse. Things have never been worse with serving the membership. Going to bet that another outside hire has caused this train wreck.

ReplyDeleteI do not think that that most people truly understand what has happened at our call centers over the last few months.

DeleteI don’t think most people truly understand what has happened in our branches over the last few months. Employee morale has declined. Branch employees are expected to be here 8:20-5:45. Add in commute times that’s 7:40-6:30. If we are here late with a member or branch issue we are expected to come in late the next morning or take an extended lunch. We are forbidden to use the time to leave early. For some of us, we have morning obligations and routines that mean coming in late or taking a long lunch is simply sitting in the branch parking lot burning our comp time. It’s not fair but it’s also not up for discussion. There’s little to no room for transfers to other branches or internal departments because your branch won’t let you leave due to their staffing.

DeleteOur call centers were shot to hell with convergence and also put our branches into complete mayhem.

DeleteMembers are aware because of the drop in service they have received in last few months. Impossible wait times

DeleteWhat's the telephone # to call to check this out?

DeleteThis Board needs to resign. Considering what they have done to SECU over the past months, they should have never named a CEO at the same time Hayes resignation was announced. Not really fair to Ms. Brady or the members and employees alike considering the state of mistrust they have caused. Why did This Board feel they were qualified to take another shot at filling the seat with the right person to lead SECU? After all they have put the members and employees through with the Hayes choice. We all know hindsight is 20/20 but for the majority of SECU employees, they had a clear sight of who should have been named CEO in 2021. Employees were ready to follow the person who for many years had prepared himself for this position. Someone who everyone respected and trusted. Someone who knew the credit union from the ground up. Someone humble and honest who doesn't waste credit union time promoting himself because he doesn't need the accolades. A credit union Leader whose focus has always been on the members and the employees of SECU. This Board did not give him consideration and we will call that the first of your many mistakes and bad judgments.

ReplyDeleteHad This Board done the right thing in 2021, we would not have suffered the losses we have to date. SECU would not have lost so many valuable employees over the past 18 months. We would have grown as the credit union always did year after year because of the services we provide. SECU's reputation would have not been tarnished. Mr. Blaine would not have needed to come out of his retirement to fight so hard for the members of State Employees Credit Union, but we thank him for all he has done to provide this place for members and employees to express their concerns. His knowledge, humilty and willingness to fight for this credit will always be a benchmark for the SECU employees to follow in their mission to make a difference in North Carolina and our Members' lives.

We will say it again : This Board has failed the credit union , the members and the employees - they have one last chance to do the right thing , Resign and vacate your positions as Board of Directors of State Employees Credit Union.

great comment couldn't agree more, JB will probably be remembered more for this blog than all the years of his great stewardship of SECU, unfortunately. I'll await the members of the board's resignation... but I'm not holding my breath.

DeleteAmen

DeleteYes, and Chairman Ayers should lead the way by submitting his resignation from the Board this week. The jury has made their decision. He has passed the point of recovery.

DeleteThis is so true. Everyone knows who should have been CEO.

DeleteJoining the amen choir here. I cannot express enough gratitude and will do everything possible to contribute to rebuilding what we know we can have here. This is not just a financial institution.

DeleteThe Board of Directors responsible for this Great Haze Depression at SECU would save themselves further embarrassment if they would just resign, no fixing can be done at this point.

DeleteWho should of been the ceo?

Delete"Who should have been the ceo?" well we know who shouldn't have ... we'll leave it at that.

Deleteincestuous relationship with NCUA, credit union regulator?Jim Hayes has a Teflon ability to wreck things and not be held accountable... this Board needs to be held accountable for hiring him--it was only necessary to read his resume to reject him. He was bragging about his time at Wescorp -not hiding it on linked in. They are incompetent fools to have put him in charge of 50 billion dollars. Or crooks themselves. Either the entire "this Board" needs to go-- not 3 of them. Getting rid of three won't clear NCSECU of "odeur d'skunk" that clings to all 11.

ReplyDeleteyes they all need to go, but first we have to work with the 3 that are up for "reelection" ... this is going to be a process not easily fixed. Shows how quickly things can unravel. Remember these folks aren't voluntarily leaving so they HAVE to be voted out. If this were about the membership they would resign (these aren't dumb folks) ... don't see that happening. So I am left to assume they like their goody bags...

DeleteCan Leigh Brady be trusted to do what it will take to right this ship? Lots of dismantling & destruction were done in just @18 months by this Administration and, as COO, Leigh Brady was second in command during the destruction. Many legacy executives were either purged or “demoted” during this time, and Ms. Brady has blood on her hands from at least one (probably more) of these “personnel moves”. She is complicit in the carnage. So, does she have what it takes or does she even have an interest in righting the ship? Based on her allegiance to this Administration and her role in the treatment of legacy employees, she may not think the ship is sinking. Only time will tell, but it’s not looking too good from this vantage point.

ReplyDelete

DeleteIf the board wanted to right the ship, they would have named an interim CEO. They named Brady permanent to plow ahead.

a lot of "legacy" there's that word again UGH!! employees have been purged one way or another and it was done with intent. With all this "legacy" knowledge gone, we could be one disaster (Hurricane) away from going out of business ... don't laugh ... we could become another blockbuster (sorry just couldn't help myself)

DeleteI am afraid Ms. Brady will have an uphill battle. Unfortunately for her, she will always be viewed by members and employees as part of the Hayes Administration - will take a 180 turn on her part to even have a chance at leading effectively.

DeleteAmen

DeleteI'll give her and the Board till the end of the month. The fiscal year ends on June 30th. After that changes need to be conveyed to the owners/members/employees of the Credit Union. What is going to change and how we are going to go about it. No excuses are acceptable after June 30th 2023 PERIOD! This doesn't excuse past behavior. You can right this ship or let it sink like the Titanic ... remember that unsinkable ship?

Delete(maybe I should have used a yacht reference, better suited for these folks).

I think the million dollar question is, why over the weekend of a resignation did the board immediately name her CEO and not post the position for all to apply like all other positions?? We name a CEO not an interim..fishy….. I think so.

DeleteKnowing Brady was COO during these past months with Hayes is a cause for concern for this member. How do we know she will do right now, when she hasn't done anything for the members and employees over the past months? Seems she was just taking care of herself.

DeleteI took will be giving her a chance to get this ship back on track. The current BOD on the other hand and piss off.

DeleteCan't change the fact Brady was 2nd in charge at SECU for almost two years of Hayes' time as CEO. From all appearances she had a close relationship with these Board of Directors. This member has tried to feel better about her appointment as CEO since she is a seasoned SECU employee but part of me has doubts - a title change doesn't change who you are. If she knew about how badly so many employees were being treated by the Hayes team, why did she not speak out? If she knew just how much of our credit union money was being wasted, why didn't she speak up? The level of service we have been receiving from the the branches and call centers have declined due to staffing issues. Our deposit rates are pathetic and we are now hearing of just how badly our money has been managed by this administration and Board. I feel concerns over her appointment are justified.

DeleteIf this were a book, the title would be “How to Ruin a Credit Union FOR DUMMIES”

ReplyDeleteDon't give em anymore ideas on what the employees should read ....

DeleteThe good old boyz network. Hayes benefitted and then he paid it forward to his buddies. Now it makes sense why so much of the old SECU leadership was pushed to the side. You can’t have them looking over your shoulder. Also explains Bomba hiring so many non-technical friends.

ReplyDeleteAdditional support of the far reaching network of the failed WesCorp executive Jim Hayes. Jim Hayes is currently listed as an advisory board member for ALM First. ALM First took over WesCorp’s advisory CUSO in 2006 in exchange for a minority ownership in ALM First per several publicly available news articles. After being taken over by NCUA at some point ALM First bought back WesCorp’s. Additional articles cite ALM First and WesCorp having together been granted a pilot program to purchase derivatives. Retiring SDFCU CEO Jan Roche’s LinkedIn likes 24 companies total, care to guess which one stands out…. ALM First.

ReplyDeleteOne of Hayes' first moves was to outsource about $5 billion of our investment portfolio to ALM First! Glad someone is finally revealing this disaster to the members.

DeleteOh what a web we weave!!!

Delete...and the investments ALM First made were in out of state, higher risk securities. BOD needs to go now, willingly or unwillingly. Or admit they endorse corruption as a new service to the members.

DeleteBuying an "investment advisory board" slot with $5 billion of members money? check it out https://www.almfirst.com/alm-first-boards/

DeleteJim Hayes smiling face is right there. Thanks for the tip. He’s on ALM Board all right. Please get us back fast to no kickbacks What a sleezy operator. Wonder if some of this Board had their hands in the honeypot too? I think Hayes and This Board view 50 billion and falling as theirs

DeleteJust like his meaningless BOUGHT awards. Except this one cost our members the big B in 5 denominations. Keeps proving he's shameless and has no conscience over and over and over.

DeleteBoard with a lawyer as a chair rolling right along says ???!!!

Should we cite more “connections” with Jim Hayes’ resume and NCUA? Former NCUA board member and eventually NCUA board chairperson, Debbie Matz (2002-2005 and subsequently 2009-2016) was heavily involved with the liquidation and resolution forward as a result of CU’s corporate credit union failures. Want to guess where she was between those two terms? Per Wikipedia: “Between her terms on the NCUA, she was the executive vice-president and chief operating officer of Andrews Federal Credit Union.” Hmmmmm

ReplyDeleteodeur d'skunk getting pretty heavy...

DeleteIn reference to an earlier comment about SECU’s status regarding the construction lending program…why don’t we ask the VP of Construction Lending? Considering he was an outside hire in 2022 he ought to be the one to know. Can’t imagine the salary he is earning while we still can’t do construction loans.

ReplyDeleteIsn't there a SVP of Business Lending as well? Yet, we don't do commercial accounts. Loan Administration comes in second to the Board in wasting money on salaries and benefits without producing results for the membership. Mortgage Lending Specialists without anything to do, waiting for the next mortgage lending boom. Might be waiting a long while in this economy.

DeleteShould we start a list of all of the VPs and SVPs over business that we do not (or cannot legally) do? Let's approximate that salary total.

DeleteThe mortgage loan specialist issue is quite sad… they look so miserable. Literally sitting in their offices all day, and I imagine fearful for their jobs. A waste of valuable employee talent…. They should be back in the branch serving members like all the others. I hope they end that, that would solve most the problems.

DeleteNew SECU: Sends out a big email about Juneteenth, yet doesn’t give us a paid holiday😂

ReplyDeleteAs a black man, it’s easy to see right through that email.

DeleteCulture department is seizing their opportunity to put something nice out there (with a timestamp) so nobody can say they haven't done anything this whole time. Don't worry, we don't think you haven't done ANYTHING. We know you've been busy bullying employees.

DeleteLiterally, the first email from the Culture club.

DeleteNot just culture club. The new top tier hires are also trying to send or respond to emails to show they are working.

DeleteNot a good sign when you hear Culture Department and immediately become nauseous.

DeleteAnyone else notice the promotion this month of the the Culture SVP to AEVP?

DeleteWhere was that job posting? 🤔

DeleteI hope it’s the first and last email from the Culture Club. They need to go too. Ridiculous amounts of money being spent on them. Sickening.

DeleteSo who (and/or what) is the hook between the board and NCUA for Hazy to have gotten into the candidate pool and succeeded in being the 'chosen one'? Sure there wasn't a real shortage of candidates even if the board wanted some 'fresh' blood in the mix.

ReplyDeleteAnd the way this self loving gym boy jumped on to the next position shows the net is wide.

Yep. How did the Board select that particular search firm?

Delete“It makes sense if you don’t think about it” -The Board

ReplyDeleteWow, the web just keeps spreading, Hayes, Russell Reynolds, NCUA, Hunt, Matz, Roche and worst of all the SECU Board. It really was an Inside Job. Stunning!

ReplyDelete"Corruption of the Best Things Gives Rise to the Worst."

Did the BOD also not see the irony is Hayes having worked for the Office of Thrift Supervision from 1991-1995? After all, the OTS was founded as a result of the savings and loan crisis as the primary regulatory body. Yet, during Hayes’ tenure additional questionable investment activities were occurring at institutions under their purview. (Ie. Superior Bank and subprime mortgage lending ironically their reporting of assets was at best questionable in their failure, sounds a bit like WesCorp) Worse yet, during the most recent 2008 crisis, the OTS was the regulatory body of many failed or bailed out institutions, perhaps some even alluded to in the documentary Inside Job. We’re talking AIG, IndyMac, Washington Mutual, BankUnited,etc. But the most interesting of all- Countrywide. Yes, that Countrywide. The one who sold all those MBSs and probably a few CMOs to WesCorp. Countrywide was one that was eventually sued to seek to recover some of the losses due to WesCorp’s failure. Just keeps getting deeper. (https://www.npr.org/2009/06/05/104979546/regulating-aig-who-fell-asleep-on-the-job)

ReplyDeleteBottom line - Hayes should have never entered the door at SECU as CEO. This Board chose this disaster for our credit union, This Board has to go.

ReplyDeleteLeigh Brady needs to go too. Namby pamby wish washy. Which way does the wind blow. Brady has no moral compass. Certainly has proven NO empathy with members. Still has no branch experience. So no empathy with most of the employees either.

DeleteSo did Gym Haze really get paid over $6million?

ReplyDeletewell apparently the board doesn't feel it's any of our concern .... just pay and shut up peon!

DeleteAlright so tomorrow when it’s confirmed full speed ahead on new/new under Brady’s leadership, all of us will combine to defeat this board. It can be done. Even though 180 days ahead of the October election they drastically changed the rules. This board intends to remain. They still hope for a big payout. Maybe had overtures from PennFed???

ReplyDeletesure they ALL want the Gym Haze payout ... you think this is about him?

Delete