Given the dilemma NavyFed now faces...

Would like to repeat the most glaring, real life example of what has gone missing with risk-based lending at SECU. What's gone missing? Fairness. Take a listen...

Ms. Leigh Brady is now the CEO of SECU. Ms. Brady is a 30+ year employee, smart lady, who came second to the former CEO in the SECU executive search process two years ago. Rumor has it that Ms. Brady and Hillary Clinton still suffer traumatic nightmares from such experiences.

As mentioned in a prior post (May 22, 2023), Ms.Brady asked to make a presentation about risk-based lending to the Board of the State Employees Association of North Carolina (SEANC). Why? Because in February, 2023, SEANC had voted unanimously to ask SECU to rescind the introduction of risk-based lending (RBL), until the two organizations could discuss that change. SECU agreed to a meeting, but in the interim introduced RBL anyway (see March 26, 2023 post). Ms. Brady wanted to clear the air on the issue of risk-based lending for the SEANC Board.

Ms. Brady summed up her far from convincing explanation of the benefits of RBL - it was weak on only two points, facts and substance -

with the following personal story.

Ms. Brady summed up her far from convincing explanation of the benefits of RBL - it was weak on only two points, facts and substance -

with the following personal story.

She indicated that her recent college graduate daughter had just bought her first car. Being a young female with little credit experience, her daughter had not qualified for the A-paper best auto rate at SECU. But Ms. Brady explained that wasn't a problem, because Mom just co-signed the loan which then qualified her daughter for the A-paper rate. See, RBL really does work well and is fair!

There was a moment of somewhat stunned silence in the room among the 40 or so SEANC board members. It was one of those: "I can't believe she just said that" moments.

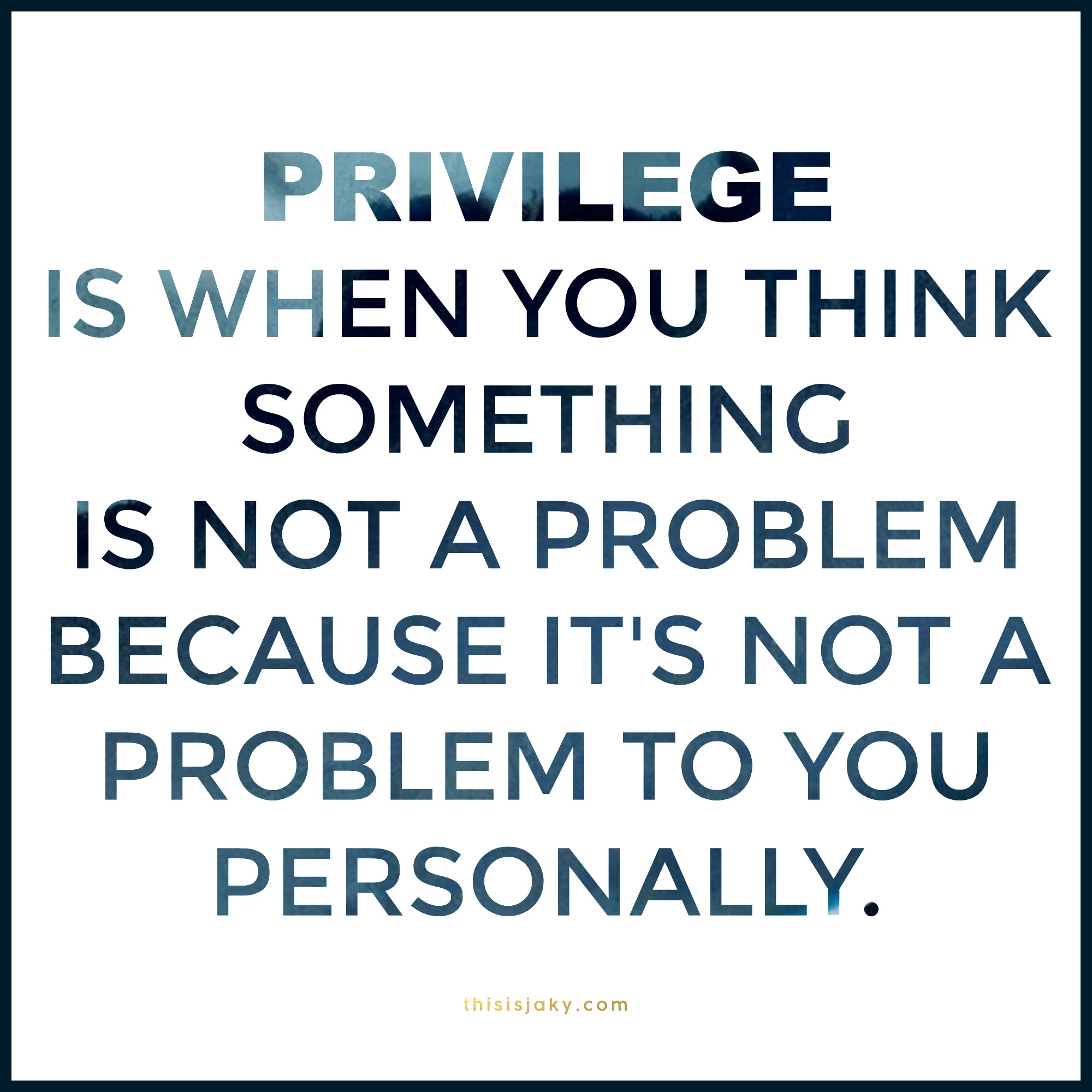

Then a young, female, Af-Am SEANC board member rose and said politely: "Ms. Brady you need to understand that most of us don't have an affluent parent who can cosign loans for us."

And, it was obvious to all in the room that Ms. Brady - and the SECU Board!! - either don't understand the financial realities of most SECU members, or simply don't care.

It proved useless to point out to Ms. Brady - though several SEANC board members tried - that her own personal example with her daughter, confirmed that risk-based lending discriminates against young people (credit scores generally -43 points below average), females ( -12 points below males), AF-Ams (-26 points below Caucasians) and people of modest means - all confirmed by independent research on credit scores.

The board members of SEANC were too polite to ask Ms. Brady why SECU felt her "credit scored and unfairly profiled" daughter, under race-based lending, represented such a high risk of default to SECU?

The credit score wasn't wrong, was it?

Then who is? Likely suspects ...

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

... "the 8" +1?

"The board members of SEANC were too polite to ask Ms. Brady why SECU felt her daughter, under risk based lending, represented a higher risk of default to SECU as her credit score indicated?"

ReplyDeleteNot sure if they were too polite or just still trying to get over the explanation she just gave them!!!

Heck these kids nowadays get out of college and have salaries equal to a 20 year vet! They just don't have a track record of borrowing ... which is what a credit score is even if you have a million dollars in a share account (savings account for the bankers at SECU!)

ReplyDeleteWow! Brady had 3 months to plan her speech, tailor it to her audience. Reassure everyone at SEANC--that is the State Employees' Association of North Carolina that Risk Based Lending will NOT hurt them or their family members. Brady is CEO of the North Carolina State Employees' Credit Union. WOW!!!!

ReplyDeleteFile this under, 'You just can't make this stuff up' or 'Fact is Stranger than Fiction'

ReplyDelete