... Esse Quam Videri.

... Esse Quam Videri.

"To Be, Rather Than To Seem."

Was asked to clarify a couple of ratios - "Capital to Assets" and "Expense to Assets" - which were put forth as "Key Goals" in last year's SECU Board approved "Strategic Plan". Here's what the Strategic Plan said:

From SECU Board's 2023 Strategic Plan:

"✅ GOAL #4: Protect and Position the Organization for Maximum Impact. As a financial cooperative, we take to heart that prudent stewardship of our member’s money is of utmost priority. Key success factors and ways that we will monitor our progress include: "

"● Maintaining capital ratio between 8% –10%."

"● Achieving an expense-to-asset ratio of 2%. "

✅ Here were the results:

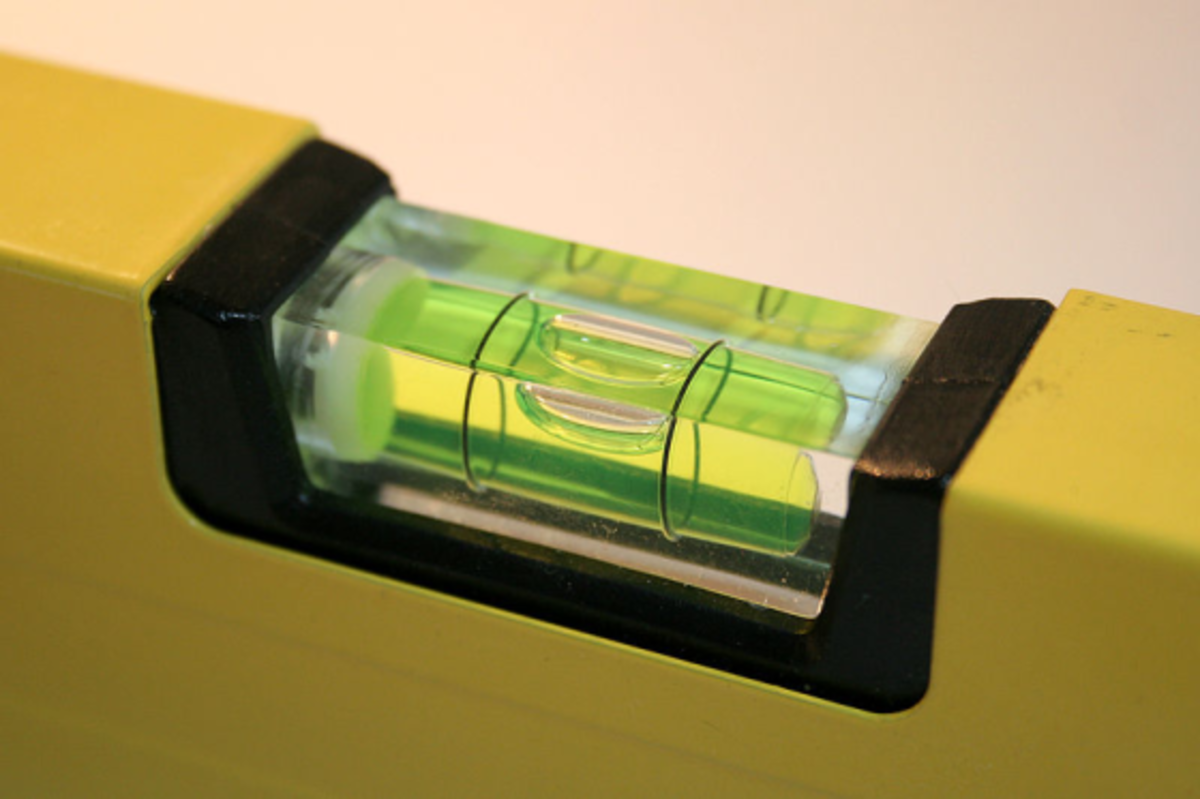

- First, look at the SECU Board approved "Targets" on the left side. Both year end ratios are above the Board's target. The Capital to Asset ratio even exceeds the Board-approved acceptable range of 10%!

- Recall that SECU has boosted assets by $5 billion with that "unusual" loan from the Fed.

- If assets were more "on the level", the ratios would be higher [you simply deduct the $5 billion loan]. The more transparent ratios are: Capital to Assets - 11.26% - and Expense to Assets - 2.42%. (It would appear that the Expense to Asset ratio, too, will exceed the Board-approved range in the near future.)

- What does this "off target", "beyond the range" management of capital cost the SECU member-owners? Holding +2.26% in excess capital (11.26% - the 9.00% Board approved target = 2.26% excess) equates to @ $1.1 billion being unnecessarily withheld from SECU members - that's why your credit union savings rates remain well below market! The Board could return those funds to the members by increasing the rate on all MMSA and all share accounts by say +3% for all of 2024. Your MMSA rate would rise to @4.75%, your share rate would rise to @3.25%. Think SECU members could use an extra $1+ billion in their pockets this year? [Why not do a "raise your hands" member survey and ask us?]

- What does the "off target" management of operating expenses cost the SECU member-owners? The difference between the Board approved target of 2.00% and the actual 2.42% is an excess, over budget cost of $200+ million annually!

... as they say "A billion here, a billion there, and after a while you're talking about real money"!

It's your money, your credit union, your choice... not "theirs".

Expect an email tomorrow from the CEO calling this fake.

ReplyDeletethey're living off the backs of ordinary folks!

ReplyDelete"Your MMSA rate would rise to @4.75%, your share rate would rise to @3.25%."

That's what the rates should be if we had competent leadership!

While we're taking member surveys, what are they doing with the results from the survey on the website?

ReplyDeleteTrying to figure out who you are…

Deletethe federal government loan makes us a welfare queen

ReplyDeleteWithholding $1.1 Billion?! That is crazy!

ReplyDeleteWho's in charge?

Rex, what are you doing with the members' money?