"Alice’s" physical ["fiscal"] appearance changes after drinking from the ["industry standard"] bottle labeled “Drink Me”!

"When Alice ("The We") "drinks up", she must navigate a much larger, unforgiving world filled with mock turtles and mad hatters. One of the key aspects of Alice’s changing size is its direct correlation to her loss of any true sense of self-identity (low rates, RBL, just another "bank")."

Alice's Growth Rate: +10.31% * Real Growth Rate: +00.4% (less than 1/2%)

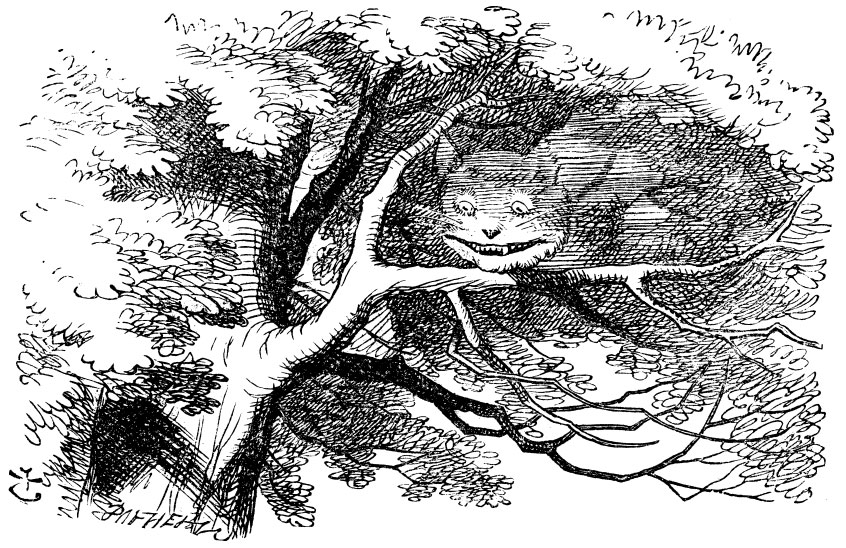

* Remember to reduce the April, 2024 assets by the $5 billion Federal Reserve "Cheshire Cat Loan"!

* Remember to reduce the April, 2024 assets by the $5 billion Federal Reserve "Cheshire Cat Loan"!

"When Alice grows taller, she is faced with a loss of control over

her surroundings (especially lending!) and a feeling of being overwhelmed by the world (surging costs, loan losses and delinquency). This

reflects the challenges that individuals face when they experience a

rapid shift and loss in their identity (from "unicorn" to "not sure what")."

The Real #'s: April, 2023 - $50.474 billion April, 2024 - $ 50.676 billion

The Real #'s: April, 2023 - $50.474 billion April, 2024 - $ 50.676 billion

"Conversely, when Alice becomes smaller, she is confronted with feelings of insignificance and powerlessness. The disorienting nature of Alice’s changes in size mirrors the confusion and uncertainty that adolescents often feel; unsure about what to do next... (when they've arrived at the end of a blind alley)."

Or who knows; maybe they're just drinking "Kool-Aid" and eating mushrooms like Alice!

People Helping People

ReplyDeleteDo the Right Thing

Bring us your Momma

SECU There is a difference ...

what part of 'their' identity crisis have I missed ...

'I’m from SECU and I’m here to help.'

ReplyDeleteWhat is the impact of my credit score on a home refinance?

ReplyDeleteRefinancing your mortgage can have a temporary impact on your credit score. When you apply for a refinance, our lending team will review your credit report (this is also known as a “hard inquiry”), which may cause a small, temporary drop in your credit score.

what a crock ... and you get dinged ...

Washington lobbyists at their finest ...

Leighdership says it all.

ReplyDelete20+ year member with A credit so risk lending doesn't affect me. But I can easily get a better car loan right now locally from a big bank and other credit unions. Your claim to have best car rates for us is not right.

ReplyDeleteWon't even mention your savings rates as the bulk of my money left last year.Even our branch staff is giving up hope

SECU new auto rates 72 months 6.25%

DeletePenFed new auto rates 72 months 5.89%

used cars too, 72 months Secu 7.25% and Coastal 6.54% for A credit. secu - choose an lose.

DeleteMismanagement. Poor management. Bad management. Management is losing our money because they don't know what they are doing. Ignorant management.

ReplyDeleteWhy is the Board so oblivious to the poor quality of service being offered? They are the ones in lala land, including 'our three' apparently.

ReplyDeleteHow can these board members be so easily persuaded? I had hopes after we got three new ones, but it seems like they have fallen right in line with the rest.

DeleteThe 3 new board members are still outnumbered. Need to vote at least 3 new members in this year.

Deleteno! A full slate of four member nominated is required to send Leighdership and The Eight a clear message. The message was NOT received last year.

Delete