Ms. Stelfanie Williams Ms. Jennifer Haygood

🔆 Dr. Williams joined the SECU Board of Directors in 2017.

🔆 Jennifer Haygood was appointed

to the SECU Board of Directors in 2019.

Since Ben McLawhorn earned the honor of a double post earlier in the week, seemed fair to give equal time to Ms. Haygood and Dr. Williams and to make a couple of more points. I know both are appreciative. Ms. Haygood is the Chef Financial Officer of the University of North Carolina System. Dr. Williams is the Vice-President for Durham Affairs at Duke University.

✅ That both women are new to the SECU Board - and that they are women - has given many members hope. Both are clearly intelligent and capable, but the open question is if they are strong enough to call for a review and reconsideration of "the last two years of progress" at the "New/New" SECU? As new members of the SECU Board - given the disruption/isolation created by the pandemic, while striving to climb the "learning curve" in a unique, complex organization, - perhaps these two Board members were too trusting of a senior Board clique pushing an agenda discredited by all prior SECU Boards?

✅ It would be more than normal for new Board members to believe, trust, and defer to more experienced colleagues. And, to believe that the information you were being given was balanced, accurate and complete. But what if you were "sold a bill of goods" by those "with an agenda"?

Could such a major deception really occur? Sure. An easy example is that our Country went to war because Iraq possessed "weapons of mass destruction" - remember? Despite the most sophisticated intelligence system in the world, we later learned that the WMD intel was not true. How could that happen - incompetence or deceit?... your choice. Yes, it does happen - and lots of innocent people end up getting hurt.

✅ The wisdom and prudence of prior SECU Boards is reflected in that 85-year unbroken record of success - quantifiable, factual, indisputable. The embarrassing, 2-year record of the "New/New" SECU is also becoming indisputable. Why wouldn't you call for an open review? What is the downside for 2.7 million North Carolinians who have put their trust in you?

👉 Ms. Haygood and Dr. Williams have now been directly alerted [link 7/10/2023 post] that risk-based lending (RBL) at SECU is unnecessarily and unjustly discriminating against the majority of SECU borrowers - costing them literally millions of dollars in financial harm. Real people are getting hurt - your fellow University co-workers, your fellow members, your fellow North Carolinians. Highly-knowledgeable financial professionals - driven by neither self-interest, nor a hidden/discredited agenda - have publicly declared you have erred. Why would you refuse to confirm that your RBL decision was based on the truth, the whole truth, and nothing but the truth?

✔ The legal imperative is clear:

From the Association of Governing Boards of Universities and Colleges - Fiduciary duties are at the heart of effective governance: Contrary

to popular belief, fulfilling one’s fiduciary duties cannot be reduced

to simply overseeing financial assets of colleges and universities.

Governing boards must make good faith decisions in the best interest of

their institutions by acting in accordance with the fiduciary duties of

care, loyalty, and obedience. While boards act as a body, “the fiduciary

duties applied by law and best practice fall on individual board

members.”

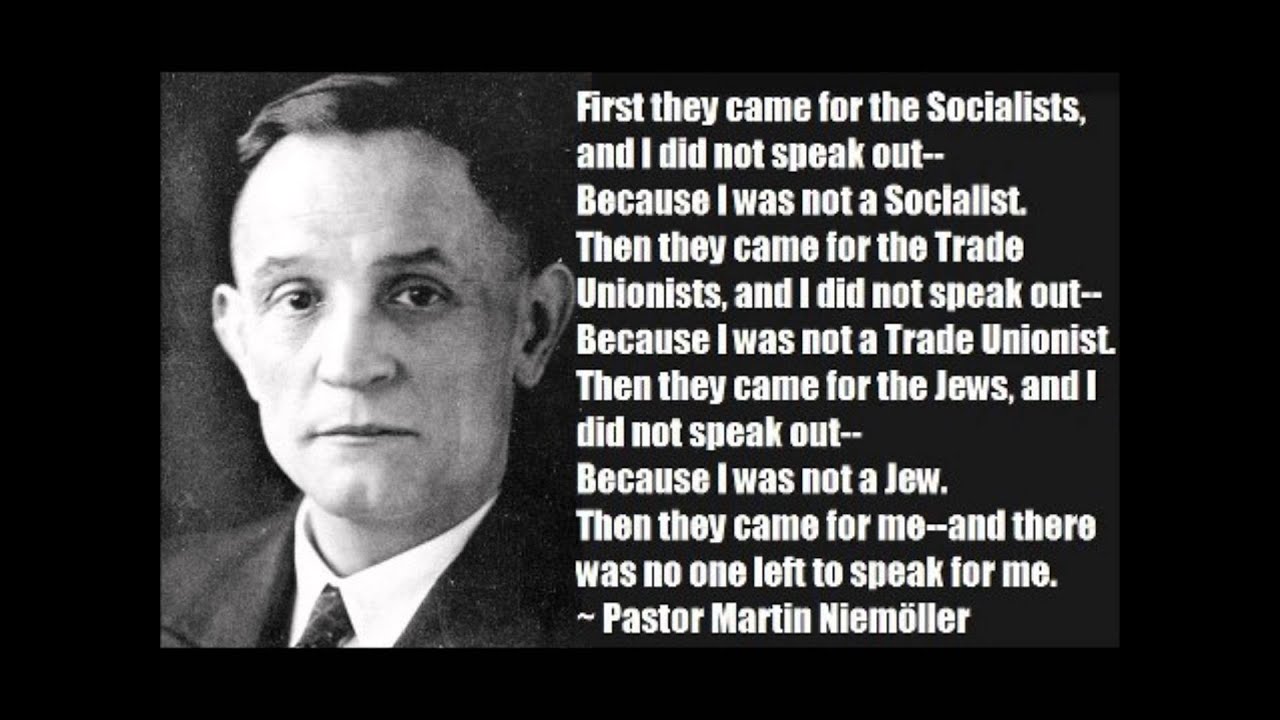

✔ The ethical imperative is clearer:

... as Germany in the1930's proved, if you're afraid to stand up for others - and for justice for all - "things" can get out of hand with disastrous consequences.

AMEN, I Pray that this gets nipped in the bud soon. The longer it plays out the harder it's going to rein this in.

ReplyDeleteThe credit union has been highly successful WITHOUT Risked Based Lending (RBL). The fact that all banks practice RBL explains it all. RBL is about increasing profits, increasing the bottom line to the financial institution. RBL is discrimination against the people that need the most help due to financial hardship. The NEW board of directors lack the history of the credit union and are busy drinking the kool-aid as the membership suffers. REPOSSESS RBL. Throw RBL in the trash.

ReplyDelete"(1) APR = Annual Percentage Rate. APR is your cost over the loan term expressed as a rate. Rates are subject to change prior to the completion of the loan. Your actual APR will be determined at the time of disbursement and may vary based on credit score, collateral, and loan terms. ... "

ReplyDelete"The tyrants in charge can't do it without the cooperation of us peasants."

ReplyDeleteThe entire board has bought into new/new. They are convinced that the policies they are implementing will benefit them and their friends much more than what was the operating principles for 85 years. This is year 1 of new/new instituted by the most incompetent and rapacious manager NCSECU has ever seen, followed by the second one. Give them time and this board will turn your credit union into a bank, and they will make off with an unimaginable amount of cash. This board can not wait for that day! Easy street is with in sight for them. Just get by October, and with the assistance of the board's new hire(electioneering firm) they are sitting fat.

ReplyDelete