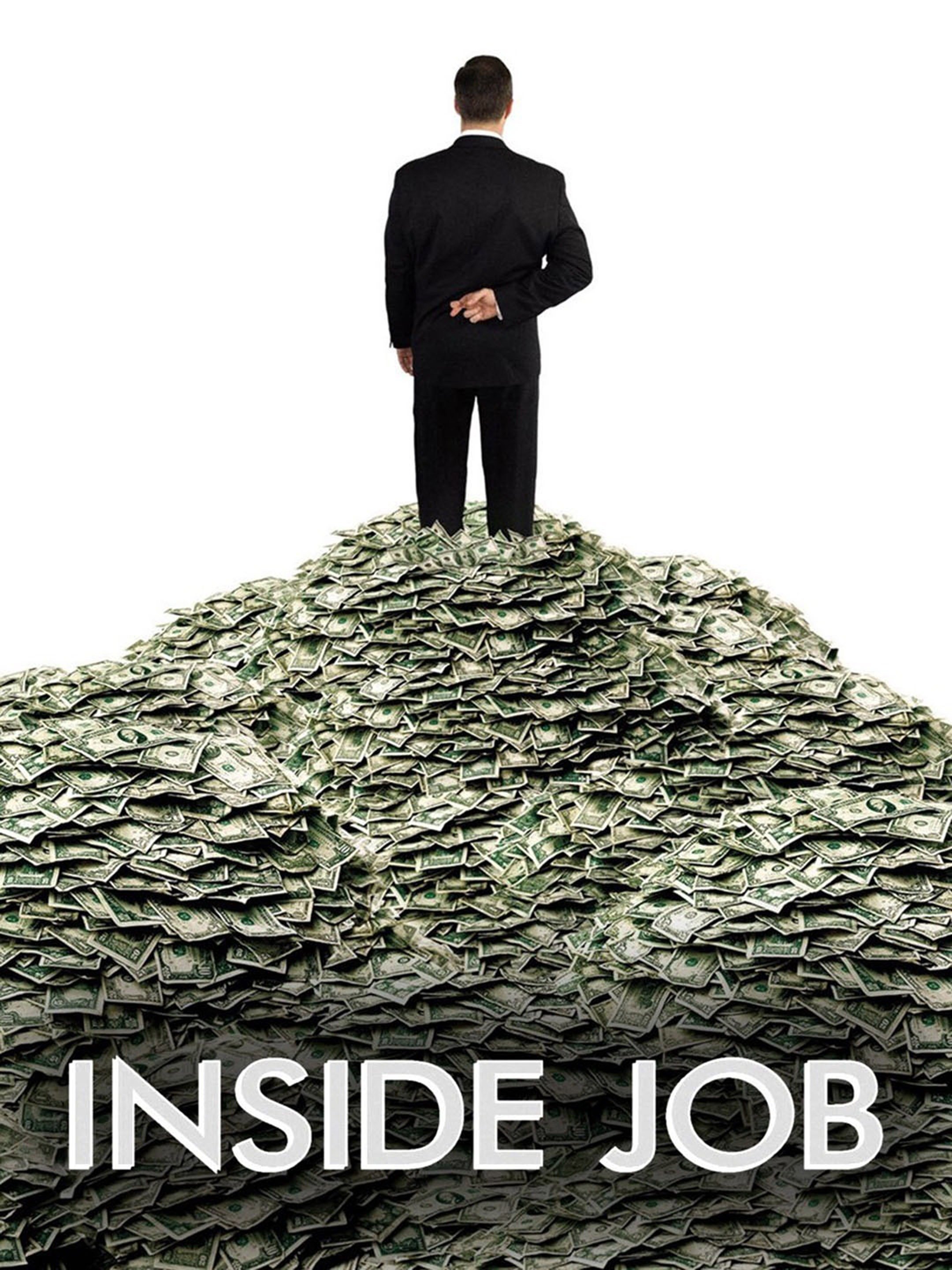

... "Insiders" didn't get fired, weren't held accountable, got off scot-free.

✅ From: A CEO of a California Credit Union Which Suffered Large $$$$ Losses At Wescorp

Date: 2023 at 11:10 AM

Subject: Filed: WesCorp Complaint

Jim-

WesCorp was placed into conservatorship by the NCUA in March, 2009.

I participated in the attached lawsuit filed November, 2009 vs. WesCorp.

✅ The NCUA intervened and took over the lawsuit.

Jim Hayes was the Senior Vice President & CFO at WesCorp at the

time and was among the defendants.

By 2008 MBO's *[see below] represented 37% of Corporate CU investment portfolios.

At WesCorp it was 80%. A reckless negligent gamble.

✅ He was the CFO. He was there. He was at board meetings. He was at

ALM meetings. He drank the Kool-Aid.

Now look at him.

Never Shocked. Just Disappointed. The NCUA should have barred him

from continued credit union employment.

The CEO

... credit union professionals nationwide did not smile about your CEO choice.

... but you were able to make SECU and its staff a laughing stock.

This Board hasn't learned anything. Even in all the controversy over the New/new. Leigh Brady must have agreed full steam ahead with new/new. Arrogant bunch. Didn't even make her interim. Out of touch with the membership, even though the membership and employees and former employees have tried to inform them. They don't listen. they don't ask. Know it all.

ReplyDeleteJim Blaine! How can we inform our membership of this board’s gross negligence and incompetence? They need to know before the annual meeting. As members, we simply have to get these greedy, good for nothings off this board.

ReplyDelete