Sprinting for the finish....

FROM THE AMERICAN BANKER NEWSPAPER

NCUA Wrestles CUs Over WesCorp Claims

✅ July 05, 2010, 2:55 p.m.

LOS

ANGELES – In what could mark the beginning of a major bloodletting in

the credit union movement, NCUA is scheduled to face off in federal

court here next week with seven credit unions over tens of millions of

dollars of potential insurance claims against the officers and directors

of WesCorp FCU.

✅ 7 Credit Unions Sue

The claims, which NCUA is seeking to wrestle away

from the credit unions, threatens to open all counts of fault lines

within the credit union movement because it will put powerful players in

the docket for the failure of the one-time $34 billion corporate, which

has already cost the movement more than $2 billion.

By

challenging the directors’ roles in the demise of WesCorp, the suit

threatens to open a rift in the credit union movement just as the cost

of the corporate bailout is growing, with NCUA having charged credit

unions a $1.1 billion assessment last month to pay for the bailout of

WesCorp and U.S. Central.

✅ NCUA Suing Itself?

NCUA claims that only it, and not the members of

WesCorp, can decide what is in the best interest “of the federal credit

union system.”

The credit unions assert that "appointing

NCUA as plaintiff – after it was already appointed defendant – would

render control of the claims “absurd and impracticable.” In other words,

NCUA would be suing itself.

✅ NCUA At Fault?

Moreover, the credit unions

claim that it was NCUA’s own oversight of WesCorp that contributed to

the corporate’s failure, costing them all of their capital investments.

“Throughout 2008 and into early 2009 the NCUA was particularly active in

its oversight of WesCorp, having placed two examiners physically

on-site at WesCorp to monitor its activities,” asserts the suit. “Yet,

somehow, the NCUA oversaw WesCorp right into the ground, placing WesCorp

into conservatorship on March 20, 2009.”

The federal

regulator’s own role, say the credit unions, has created reluctance

about pursuing claims in the case. Since it became WesCorp’s conservator

– some 15 months ago – the NCUA has been “investigating the failure of

WesCorp and whether any of its former officers or directors are legally

culpable.”

“With representatives on the ground long

before the conservatorship, and 15 months to investigate “the managers

and boards who exercised such poor judgment,” the NCUA “still has not

decided whether or not to initiate legal action against the former

directors and former/and or current officers of WesCorp,” states the

suit. “Despite its ambivalence as to whether or not it will pursue

claims against the defendants, the NCUA has nonetheless intervened in

this action.

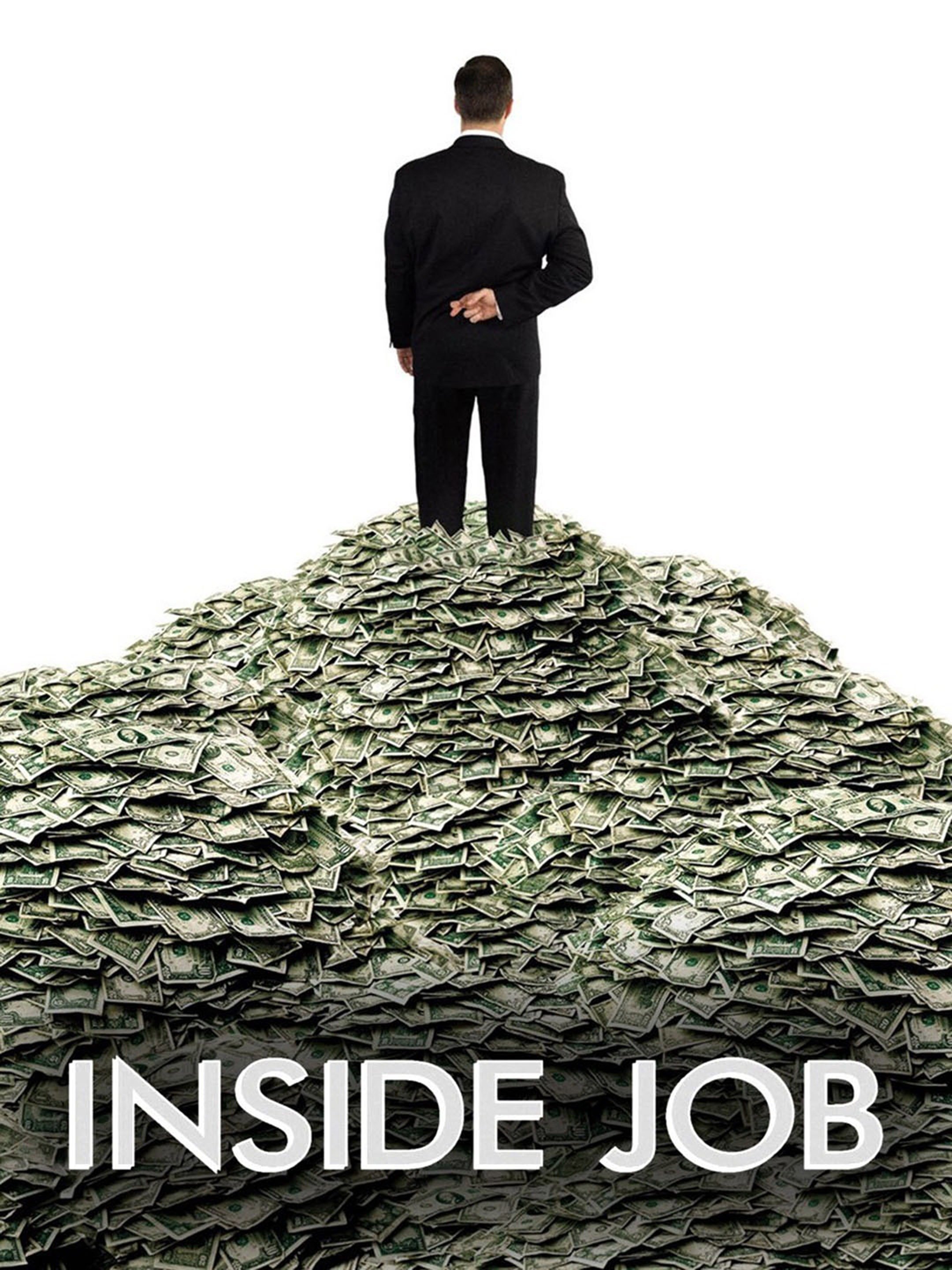

✅ Inside Job?

“Now the NCUA – an entity that shares the

blame for the failure of WesCorp – seeks to substitute itself as

Plaintiff, and wrest this litigation out of the hands of the seven

retail credit unions that have prosecuted it to date, even though the

NCUA, as compromised as it is, has not determined whether it will pursue

the action in their stead.”

Well, do you think NCUA "co-opted" the lawsuits? (Give you 3 guesses!)

Well, do you think NCUA "co-opted" the lawsuits? (Give you 3 guesses!)

... but you were able to make SECU and its staff a laughing stock.