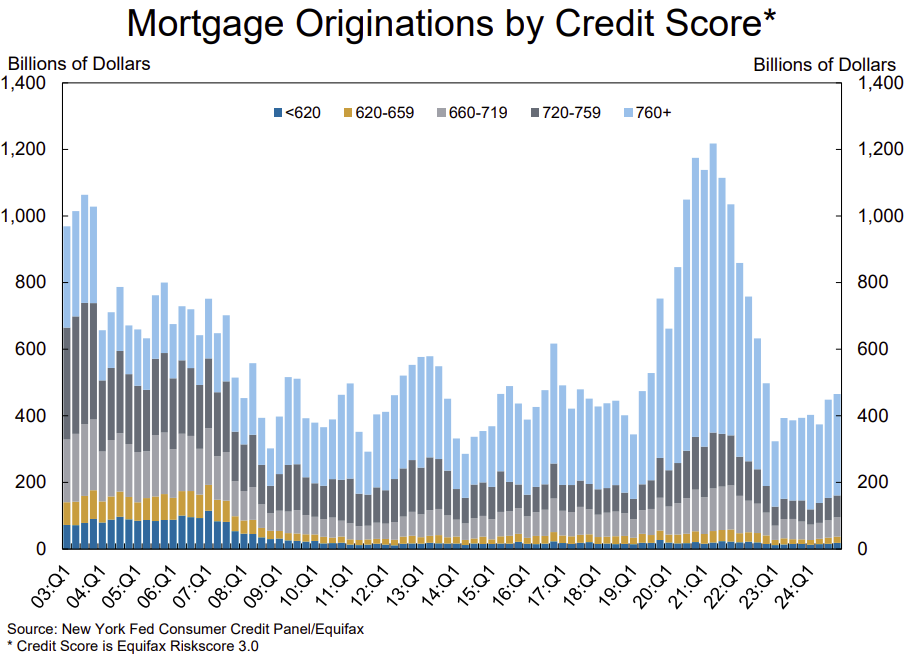

✅ "Look at the difference in credit scores in the recent period .

Recently there have been almost no originations for borrowers with

credit scores below 620, and few below 660. A significant majority of

recent originations have been to borrowers with credit score above 760." [Fed. Reserve/McBride]

✅ So, if you believe the Federal Reserve, race-based/credit score lending is now having a profound effect on younger members, females and Af-Am folks who statistically have lower credit scores [link to post]. The reasons that many SECU members have lower credit scores is often due to unexpected and often tragic events in their lives - Hurricane Helene for example in Western North Carolina [link to post]. But algorithms don't really care to hear about all that ...

😎 Not to worry! The "New/New" crowd at SECU has developed a new mortgage loan just for you - the undeserved!

❋❋❋ Need an affordable home loan? ❋❋❋

the secu gen X mobile home loan

ReplyDeletehope you own your land because the vulture's are sweeping in and buying up mobile home parks for millions !!!!

Deletehard to compete with corporate investment funds ... you know “privatize the gains and socialize the losses” ... aka new/new

Deletehttps://www.ncparks.gov/ so folks in NC can also live in there cars!

ReplyDeleteAre these numbers for SECU specifically or for the industry at large?

ReplyDeletehttps://video.search.yahoo.com/yhs/search?fr=yhs-mnet-001&ei=UTF-8&hsimp=yhs-001&hspart=mnet¶m1=3093¶m2=84460&p=sleeping+in+walmart+parking+lots&type=type9014486-spa-3093-84460#id=1&vid=524260774c81ee691a05414d0de643c0&action=view

ReplyDeletenext lending innovation from secu our young members will be a 'live in the basement with your parents' rewards card

ReplyDelete'You'll own nothing and you'll be happy' new/new

ReplyDeletelow relocation expense

ReplyDeletehurting real people in our state.

ReplyDelete