You learned in Part VII [link] what you already knew, successful businesses sell for a premium over book value. That's just common sense, basic economics, sound business practice - except with credit unions!

"Can’t wait for you to explain why BECU [a current, proposed merger] would accept something that you can’t show has ever happened."

Have you paid attention to the growing number of recent purchases of banks by credit unions nationwide? Here take a look at some articles [link] or here's a list [link]. Here is an interesting fact about those purchases:

"The premium required to undertake the transaction might not make economic sense. For example, a credit union cannot legally purchase bank stock in most instances. It must purchase the assets and assume the liabilities of the bank, which is then liquidated. The consideration must be paid in cash ... All other things being equal, a credit union purchasing assets and assuming liabilities must be willing to pay more for the target institution than would a bank to offset the tax liabilities and additional legal costs." [link]

✔ Just in case you might miss the point. Trolls try to claim no credit union [BECU in this example] would take on another credit union, if the reserves/equity was fairly paid out to the [SAFE] member-shareholders. Clearly not true, a bit silly, just more troll trash... here's why.

When a credit union buys a bank, it pays a premium (much more) than book value for the bank. The credit union pays out to the bank shareholders the book value (equity/reserves/capital) plus the premium in cash!

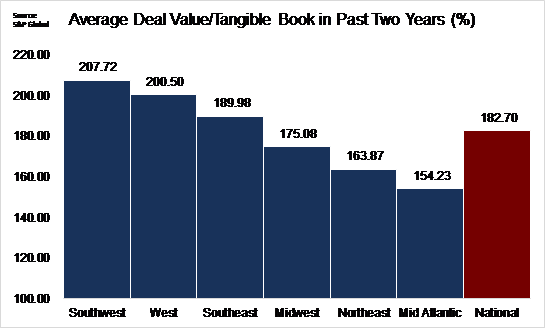

To give you an idea of the premium price being paid for banks, take a look at this graph:

* As you'll, note the premium paid nationwide has been 182.70% (1.8X) of book value, in the west coast market the premium was 200.50% (2X) book value. [link]

✅ If you can acquire a bank and pay out the equity in cash to bank stockholders, why would you try to screw the loyal member-owners of a credit union [SAFE] out of their legally owned equity?

😎 Why is the Board of Directors of SAFE CU giving away a business owned by its' member-shareholders and clearly worth between $400 million (1X) and $800 million (2X)?