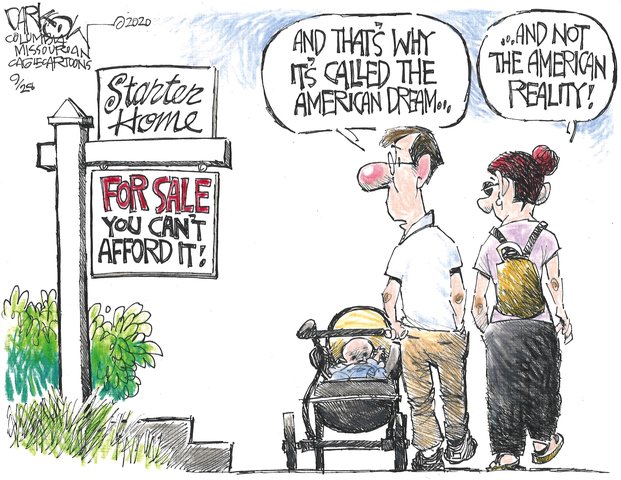

But only for 30 years!

But only for 30 years!

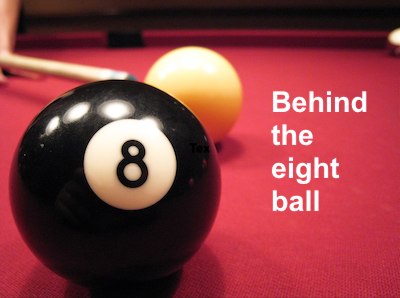

✅ Why booking a lot of 30-year fixed rate mortgage loans is a management mistake of the first order for all financial institutions... a mistake that the SECU ELT has already made.

😎 Question: If you had $100,000 in savings and SECU offered you a guaranteed fixed rate CD for 30 years at 3.25%, would you make that investment? Of course you wouldn't with the current economic uncertainty (and with the current 1 year rate at 4%!). No, just wouldn't be smart, would it?

Well, you have decided as a member to make that investment! ... or at least the lending gurus at SECU have made that mistake on your behalf! Remember this [link]:

✅ "Who "funds" our loans at the Credit Union? In 2021 and 2022 SECU made over $6 billion in 30-year fixed rate mortgages at around 3.25% and "funded" those loans with other SECU members' hard earned savings dollars!"[That means you!]

😎 Question:Why would anyone do that with your savings?

1) Because "they" have figured out how to pay SECU savers 4% on CDs, invest your funds at 3.25% and not lose money.

2) Because the overall average low rate being paid for all SECU deposits and savings is only @2.50%. So, earning 3.25% while paying 2.50% is a really great deal as long as you don't include our operating costs of 2.30%.

3) Although 30-year fixed rate mortgages are now over 6%, members will become very eager to refinance their existing 3.25% mortgages.

4) Rates will move lower and stay lower for the next 30 years. The Fed is targeting rates @2% so plus our operating expenses of 2.30%... well, don't exaggerate the loss.

5) Maybe SECU members won't notice for 30 years ... even with AI.