GSEs: People Helping People?

GSEs: People Helping People?You might think that I have some vendetta against GSE's (Fan/Fred) and the 30-year fixed rate mortgage. Not really. As they say, "it is what it is"... and that's not likely to change

In years passed, SECU became certified, originated, and sold mortgages to a GSE; the CEO at the time was even appointed to serve on the GSE's national credit union advisory council. SECU members believed that a 30-year fixed rate mortgage was a better choice - find a way to make that happen! A couple of problems quickly appeared:

1) We've already talked about the problem (2008) [link] of unlimited federal guarantees used to politically prop up these for-profit institutions' 1930's era self-interest.

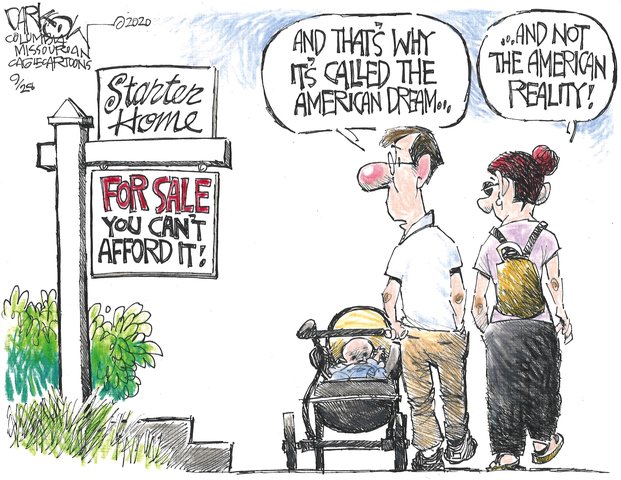

2) "The American Reality" was the 20% down payment and pristine underwriting requirements precluded most SECU members from qualifying - the GSEs basically just skimmed off the "no-risk" mortgages from N.C. banks and credit unions.

3) "The American Reality" was the financial goals of the for-profit GSE (make more money!) quickly came into conflict with the financial goals of the not-for-profit Credit Union (leave more money in members' pockets!). Fees, PMI, and other surcharges abounded!

3) "The American Reality" was when SECU sold a mortgage (6.25% for example) to the GSE, it was paid .25% "to service the loan" (collect payments, etc}. The real economic value in the mortgage (the remaining 6% in interest) was exported out of North Carolina, rather than retained to circulate in North Carolina communities (same type problem as exporting manufacturing jobs to China!)

4) "The American Reality" was SECU could not financially survive permitting the GSE to extract 95% of the value of the mortgage from the Credit Union - let alone the financial harm caused to local jobs, businesses, and the North Carolina economy.

5) The GSE "game" hasn't changed, still a taxpayer-supported problem waiting to happen again, a money loser for SECU, and an economic loss for North Carolina.

😎 😎 😎 Then was it possible to try and create a different mortgage that was a better deal for SECU members?

88% of Americans say owning a home is a key measure of financial success, with 60% of Gen Z saying it has become more important in the last five years.

ReplyDelete