You learned in Part VII [link] what you already knew, successful businesses sell for a premium over book value. That's just common sense, basic economics, sound business practice - except with credit unions!

"Can’t wait for you to explain why BECU [a current, proposed merger] would accept something that you can’t show has ever happened."

Have you paid attention to the growing number of recent purchases of banks by credit unions nationwide? Here take a look at some articles [link] or here's a list [link]. Here is an interesting fact about those purchases:

"The premium required to undertake the transaction might not make economic sense. For example, a credit union cannot legally purchase bank stock in most instances. It must purchase the assets and assume the liabilities of the bank, which is then liquidated. The consideration must be paid in cash ... All other things being equal, a credit union purchasing assets and assuming liabilities must be willing to pay more for the target institution than would a bank to offset the tax liabilities and additional legal costs." [link]

✔ Just in case you might miss the point. Trolls try to claim no credit union [BECU in this example] would take on another credit union, if the reserves/equity was fairly paid out to the [SAFE] member-shareholders. Clearly not true, a bit silly, just more troll trash... here's why.

When a credit union buys a bank, it pays a premium (much more) than book value for the bank. The credit union pays out to the bank shareholders the book value (equity/reserves/capital) plus the premium in cash!

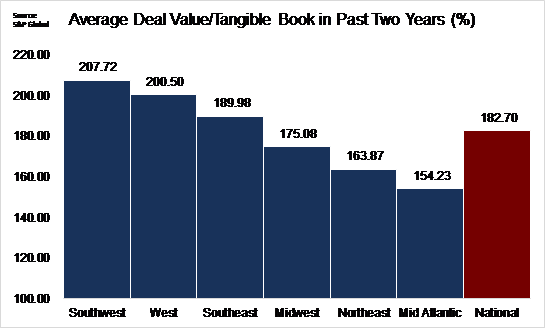

To give you an idea of the premium price being paid for banks, take a look at this graph:

* As you'll, note the premium paid nationwide has been 182.70% (1.8X) of book value, in the west coast market the premium was 200.50% (2X) book value. [link]

✅ If you can acquire a bank and pay out the equity in cash to bank stockholders, why would you try to screw the loyal member-owners of a credit union [SAFE] out of their legally owned equity?

😎 Why is the Board of Directors of SAFE CU giving away a business owned by its' member-shareholders and clearly worth between $400 million (1X) and $800 million (2X)?

as I've been often told, follow the money ...

ReplyDeleteTroll is having a hissy! Good news - troll pants are not all wet,; bad news - because they have once again burst into flames!

ReplyDeleteWill try to parse out some of the fluff later from the ashes... as the fire dies down.

Some of us know who the troll is

ReplyDeleteTrolling: "Since CU’s can’t buy other CU’s"

ReplyDelete5:56Pm Troll trash alert!!! A credit union can buy another credit union in exactly the same method as if buying a bank. (Don't wet your pantaloons, check the law.)

DeleteTrolling: " There is no consideration in CU mergers."

ReplyDelete6:05pm Agree that it is "inconsiderate" for a board tro give away millions of dollars of other peoples money ("OPM"). It's also called gross negligence in the real world .

ReplyDeleteThis "Godfather" discussion is about the legal and economic reality that "consideration" can and should be paid in credit union mergers.. and credit union boards which do not do so are potentially at personal risk...

"Things" have changed with credit unions... that's ok... consolidate/convert as the market may dictat... that's ok too..

But giving away multi-million dollar businesses is not going down quietly... If you're a believer in the capitalist system, you know this is a scam... doesn't compute economically.

Board members are personally liable...ignorance is not a defense.

100% false. Look at NCUA rules 12 CFR; 708b which explicitly prohibits:

Delete- paying the merging CU

-paying its board

-paying its members

-paying an inducement to complete the merger

7:16pm MAJOR TROLL TRASH ALERT!!!!

DeleteThis may be the worse yet, but it has a lot of competition for that rating from the "TT" dumpster!

Will do a post on 12 CFR; 708b later so that you can confirm that all 4 statements are bafflegab!

For now, just hold this wee fact to heart, the troll seems to "overlook" or "dismiss" the fact that both BECU and SAFE are state-chartered credit unions, not federal credit unions. Different rules apply.

The easiest example to point out in this merger is the statement: "-paying its board " is prohibited.

Most readers don't realize that in Washington State, credit union boards may be compensated. At least from an average credit union member's perspective the BECU Board is very, highly compensated!

Want to take a guess how much?

How much? A lot. The 2 SAFE board members joining the BECU Board will love it. But of course it didn’t influence their vote.

DeleteTrolling: " I am certain you are aware of capital requirements. BECU has excess capital but drooping from 12.45 to a little over 8% isn’t advisable and would never be approved."

ReplyDelete6:26pm Troll trash alert!!! If BECU merged with SAFE after a minimum distribution of $400 million to SAFE member-owners, BECU's capital ratio would be @ 11%.

ReplyDeleteLook it up at ncua.gov. Why is the troll flaming his denims with such "beau-gas" info... and on who's behalf.

'you can change a wise person’s mind with one fact. But you cannot change a fool’s mind with 1,000 facts'

ReplyDeletemany wolves among the sheep...

ReplyDeleteTrolling: Still on your same false analogy. The capital isn't given away. It goes with them. How would a member have a "claim" on their original CU capital, but not on the new one? Still waiting for you to address that.

ReplyDelete8:33 am Troll trash alert. Trolls often struggle with the obvious.

DeleteWhy should SAFE members pay $400+million bucks to join BECU when they can do so today by just opening a $25 share account online?

In the BECU/Safe example. EVERY SAFE MEMBER CAN JOIN BECU FOR FREE!!!

SAFE members would rather have the cash and make their own decision. Wouldn't you? Sounds democratic!

BTW, this troll can probably help you "get in" on a deal to buy the Brooklyn Bridge if you're willing....

Trolling: "False. CU's can buy assets or liabilities, branches, but they cannot buy another credit union."

ReplyDeleteTroll trash alert!!! Let's see... after SAFE fairly distributed the $400 million in reserves to the 244,000 SAFE member owners, all that would remain of SAFE are the assets (loans, investments, etc) and the liabilities (member deposits). BECU could then buy all that remains of SAFE CU... (reread this post to see what a bargain that would be)... a package worth as much as $200/$400 million.

If BECU doesn't want to buy SAFE, there are plenty of other credit unions around who would.

The SAFE Board did consider other offers, didn't it?

Trolling: "BECU Board is obligated to put their institution in the best place they can"

ReplyDeleteQuestion: Doesn't the same obligation apply to the SAFE Board?

Trolling: "SAFE members realize the enhanced capabilities the new scale of the combined organization will now have."

ReplyDeleteQuestion: What are the "enhanced capabilities" that SAFE members will receive? The merger announcement is at best "vague" about any specific value the SAFE members will receive - neither rates , nor services appear superior at BECU.

And recall that the costs of operating ("op-ex") BECU are substantially higher than at SAFE... a merger with "dis-economies of scale"?

SAFE members are getting to keep everything they currently have and also gain access to everything BECU has.

Delete5:47pm Troll trash: Suspect SAFE member shareholders would prefer to receive $400+ million in cash and join BECU for free if they would like.

DeleteBut, why argue, give SAFE members that choice.

11:07, good point. SAFE members aren’t getting anything they couldn’t get by staying independent. Go read BECU employee Glassdoor ratings about what’s happened to BECU’s culture under new leadership. Hopefully SAFE employees know what they’re getting themselves into. We know first hand at SECU that internal culture changes bleed over into poor experiences for members, too. Maybe why BECU has lost assets and membership?

DeleteTrolling: "If we pretend for a second it’s actually a capital give away as you describe, that would be pretty bad for a board to just handover free cash and their CU to another for zero in return. "

ReplyDeleteQuestion: So the equity/reserves are now "pretend capital" The members, the regulators and the courts don't think so.

But I must totally agree with you that if it is not "pretend capital"; it... "would be pretty bad for a board to just handover free cash and their CU to another for zero in return. "

Glad you're seeing the light and acknowledging that this merger doesn't appear to pass the sniff test for the SAFE Board.