“This is the business [the credit union] we’ve chosen.” - V. Corleone

Hope you took a look yesterday at the following post [link] - explaining the current unseemliness of credit union mergers - for a couple of reasons:

1) CU merger malpractice is widespread and has become predatory,

2) the lack of effective regulatory oversight needs legislation,

3) or the clear breach of fiduciary duty by credit union boards and senior management requires litigation,

4) And, as with our society... with credit unions , when anything goes everything goes.

😎 A "Hobson's Choice"?: Credit unions through mergers 1) are being mismanaged and misled or 2) are being sacked and looted?

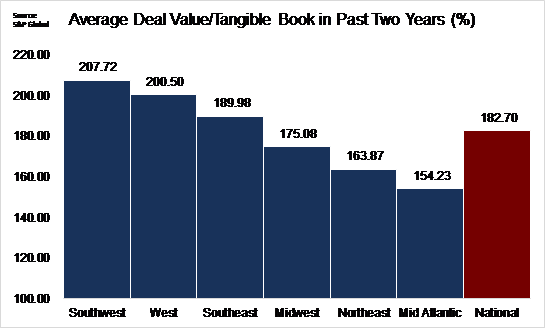

✅ In our example merger between BECU/SAFE, it is indisputable that 1) SAFE CU is worth over $400+ million, 2) SAFE members can obtain the benefits of BECU membership for free by simply joining BECU (open membership), 3) the SAFE Board could easily and legally disburse over $400+ million to SAFE members and the merger would still be an exceptional purchase for BECU, 4) the merger proposal approved by the SAFE Board fails every test of economic, open market, business reasonableness, and 5) the current SAFE Board recommendation to the membership is financially deplorable - no if's, and's, or but's!

✅ A couple of commenters have rightfully asked: "Was the potential sale of SAFE CU publicized, so that other credit unions could review and bid on the acquisition?" If not, why not? How did the SAFE Board of Directors decide that BECU represented the best offer?

If you were selling your home, would you list it publicly to seek the best price? Or as with this "sale", just give it away? Not seeking multiple bidders, nor the best price for SAFE shareholders fails the standards of "best practices", due diligence and fiduciary duty in the real world.

Some commenters make the mistake of believing only a "larger" credit union could purchase the $4 billion SAFE - absolutely not true. Even a $100 million CU could offer to merge with SAFE creating a $4.1 billion new CU.

What the smaller, acquiring credit union might bring is a new energetic board with new ideas and a new vision on how to continue the growth of "the fastest growing CU in Sacramento" (according to BECU).

✔ A different, more inspirational acquirer - small or large - could replace the existing board which is ready to throw in the towel, ready to sell out. Who wants to to work for a group which has given up?

✔ And, perhaps the new acquirer could bring forth some "new creative blood" to replace the senior management who has already volunteered to step down; and evidently, sees no benefit, no way forward as a local, independent California-focused institution. Why has the senior leadership given up on the existing staff and culture? What - or who - is actually the problem here requiring merger?

California alone has 234 other local credit unions which might be interested in taking over SAFE and leading it forward. Some are larger, some are smaller. There are even two or three existing, Sacramento-based credit unions which have better operating expense and capital ratios than BECU!

So, want to lower costs and truly enhance local service for SAFE member-owners ... think about the economies of scale and real service benefits of combining with other local, California credit unions! Why not seek answers locally, rather than take orders from Tukwila?

😎 Probably not too difficult to find a few exciting, young CU leaders who would be willing to step up to this challenge, this wonderful opportunity... in exchange for that $1+ million CEO pay package! If you think no one is interested, try asking around...

✔ All California credit unions could offer a better financial deal to SAFE members than the merger currently approved by the SAFE Board

Don't believe that last statement, wanna bet?

Don't believe that last statement, wanna bet?

Credit union "new/new" merger inbreeding? Sounds sorta pointless...

Credit union "new/new" merger inbreeding? Sounds sorta pointless...  .

.

- "Members of Spirit Financial CU Reject Merger Into Credit Union 1"

- "Members of Spirit Financial CU Reject Merger Into Credit Union 1"

Sometimes telling the truth is, well, telling the truth. Ed Speed lays it on the line in this CUDaily opinion piece

Sometimes telling the truth is, well, telling the truth. Ed Speed lays it on the line in this CUDaily opinion piece