Wonder why not?

Wonder why not?

😎 The Chief Legaler at SECU has concocted some more mischief to further shut out SECU members from participating in the governance of their credit union [link].

The record so far has been sullenly dismissive: 1937-2022 - Speak freely!; 2023 - You have 2 minutes!; 2024 -You may not speak!; 2025 - Don't even try it! Evidently in the future it will be an even more brazen - "STFU" (Speaking Terminated, Forever Unacceptable") ! At least that's what the letter implies, if 300,000 signatures will now be required to address the Board.

The SECU bylaw amendment to achieve this further prohibition must be submitted to the N.C. Administrator of Credit Unions for approval.

😎 As an SECU member have you received any information, heard any discussion about the proposed bylaw amendment or the reasons behind the changes? Had a chance ask questions, express your point of view?

"In amending a previously adopted bylaw, make sure that the rights of all members continue to be protected. The surest way to provide this protection is to prevent bylaws from being changed without first giving every member an opportunity to weigh in on a change. And bylaws should never be changed as long as a minority greater than one-third disagrees with the proposal."

😎 Why hasn't the SECU Board provided members with information about its intent to amend the SECU Bylaws - the only document which protects SECU member ownership and governance rights?

😎 Could the proposal be: "Art. XX, Sect. X - SECU Members, Like Children, Should Be Seen Not Heard."

✅ Even if the SECU Board chooses to ignore the membership, shouldn't the N.C. Administrator of Credit Unions be interested in hearing from the 3 million North Carolinians who will be affected?

... an unsettled and unsettling national issue.

✅ "Background of Conservatorship" [source: J.P. Morgan]

"In response to the Global Financial Crisis, the U.S. Treasury placed Fannie Mae and Freddie Mac into conservatorship in September 2008. This action was intended to stabilize the mortgage market and restore confidence in the government-sponsored enterprises (GSEs).

Since the start of the conservatorship, the Treasury has injected approximately $190 billion in capital into the GSEs, from a total commitment of up to $446 billion. In exchange, the Treasury received warrants to purchase up to 79.9% of common stock and approximately $190 billion in senior preferred shares with a 10% dividend rate. The senior preferred shares have generated $300 billion in dividends for the Treasury. However, the preferred stock agreement was recently modified to allow the GSEs to retain capital instead of making dividend payments.

To compensate taxpayers for the forgone dividends, the liquidation preferences for the senior preferred shares are being increased by the amount of capital retained. As of the third quarter of 2024, the Treasury's liquidation preference for the senior preferred shares stands at $340 billion. As a result of retaining capital, Fannie Mae and Freddie Mac increased their combined net worth to $147 billion as of the third quarter of 2024. Despite this steady growth, the GSEs remain well below the minimum regulatory capital framework requirements set by the Federal Housing Finance Agency (FHFA) in 2020.

Under the risk-based capital requirements, the GSEs must maintain minimum regulatory capital levels, including a tier 1 capital ratio of at least 2.5% of their adjusted total assets. As of September 30, 2024, Fannie Mae's capital requirement is $187 billion, while Freddie Mac's is $141 billion, resulting in a combined total requirement of $328 billion."

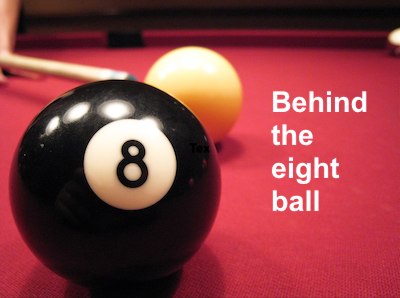

😎 After 17 years of conservatorship by the taxpayers, Fan/Fred remain under-capitalized by -$181 billion [required: $328 billion, actual: $147 billion = -$181 billion!]... even though the required capital level is only 2.5%.

✔ "New/new" have you really thought this partnership through for SECU mortgages ... a propped up 1930's-era legacy, tax-payer subsidized, in a 17 year conservatorship, under-capitalized, with a risky political future, in an uncertain world economy!

Tell us how you "risk-rated" all that, for the SECU Board, please...

What could go wrong... again?

What could go wrong... again?

People Helping People - Really?

People Helping People - Really?

😎 Was trying to hurry and finish up on the fixed-30/ARM discussion, because educating folks on mortgages in a few blog posts is overly ambitious, too technical, and downright dull. But had a long-time member/former employee, whom I greatly admire, submit a comment that demonstrates the reality of on-going member concern. Here take a look [link - first comment].

Regardless of what is said, members are going to "worry" about an ARM! In this case if the worry is too great, sound advice is given (2nd commenter) to consider refinancing to a fixed rate, especially if you have 20%+ equity in the home.

SECU "new/new" lenders have stumbled into a blind alley on SECU mortgages and are taking the members along for the ride . How so? We've discussed why selling member mortgages to the failed, tax-payer subsidized, for-profit GSEs (Fan/Fred) is a mistake [link] waiting to happen - again! , will reduce the ability for SECU to help first-time home buyers, will strip the interest paid from local N.C. communities (and SECU savers!), exporting it to countries like China/Japan [link], will actually increase the cost of a mortgage for SECU borrowers, and will end the role of SECU as a high-value alternative mortgage source for North Carolinians.

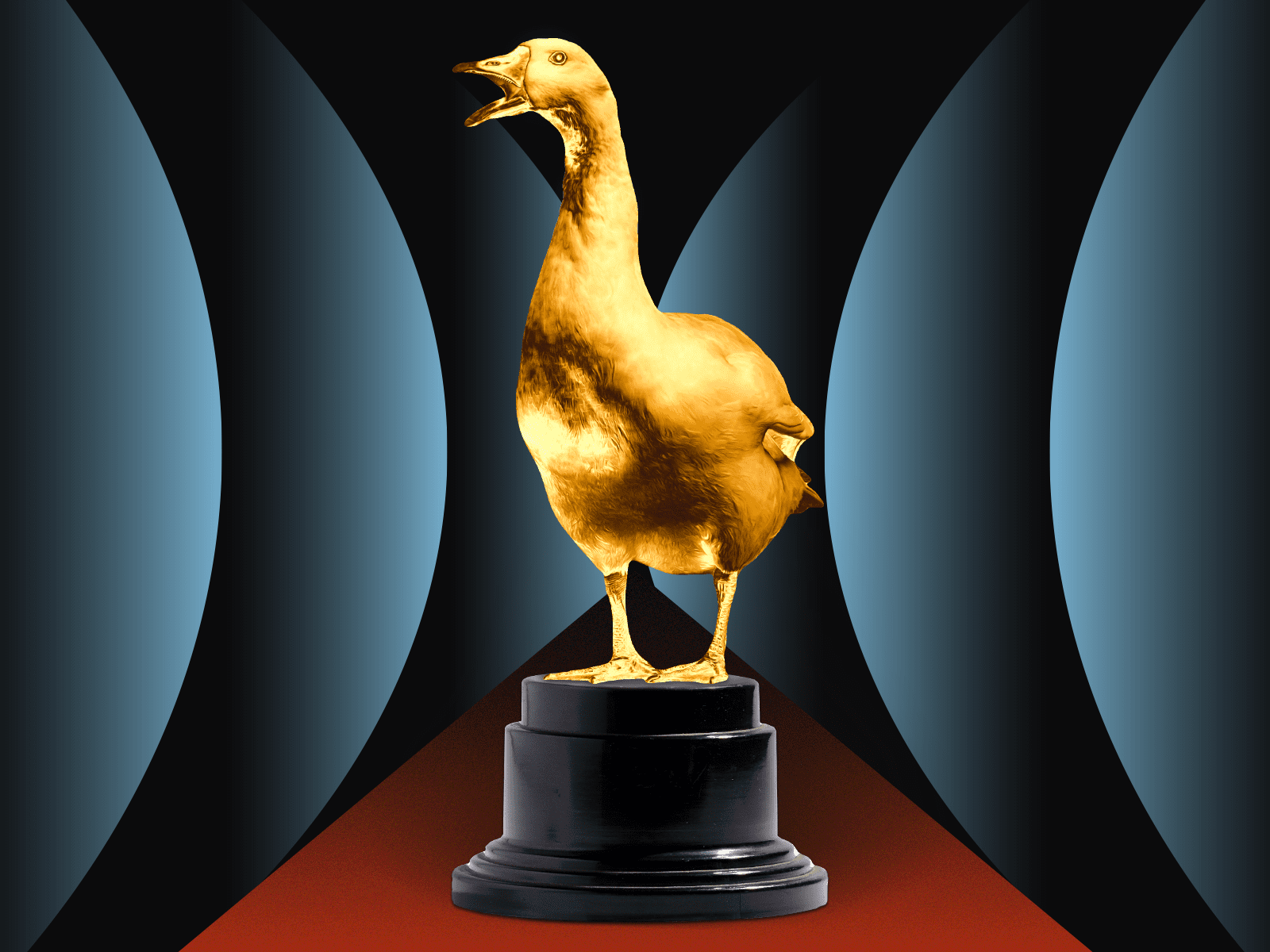

"New/new" has killed the golden goose? [link] Yes! 1) Sound financial institutions aren't allowed to hold many 30-year fixed rate mortgages on their books. SECU "new/new" has just filled that risk bucket to overflowing with the lowest fixed rate mortgages in recorded history [link] (@3%range) - and can't take on more, only choice left is to sell them to Fran/Fred!! 2) Then to make matters remarkably worse, the SECU "new/new" have now unfavorably mis-priced the SECU ARM to the severe detriment of potential member borrowers .

"New/new" has killed the golden goose? [link] Yes! 1) Sound financial institutions aren't allowed to hold many 30-year fixed rate mortgages on their books. SECU "new/new" has just filled that risk bucket to overflowing with the lowest fixed rate mortgages in recorded history [link] (@3%range) - and can't take on more, only choice left is to sell them to Fran/Fred!! 2) Then to make matters remarkably worse, the SECU "new/new" have now unfavorably mis-priced the SECU ARM to the severe detriment of potential member borrowers .

✅ As currently priced [link], the SECU 30-year fixed rate is at 6.0%, the posted SECU ARM rate is at 5.6%. less than a 1/2% difference.

😎 No SECU mortgage borrower should take on the "worry" of an ARM at 5.6% when a fixed rate is available for < 1/2% more! Current SECU ARM pricing is an egregious betrayal of SECU member trust by the "new/new".

✔ So, dear friend commenter, not sure of the details on your current mortgage, but any new SECU ARM borrower should be rightfully "worried"...

But only for 30 years!

But only for 30 years!

✅ Why booking a lot of 30-year fixed rate mortgage loans is a management mistake of the first order for all financial institutions... a mistake that the SECU ELT has already made.

😎 Question: If you had $100,000 in savings and SECU offered you a guaranteed fixed rate CD for 30 years at 3.25%, would you make that investment? Of course you wouldn't with the current economic uncertainty (and with the current 1 year rate at 4%!). No, just wouldn't be smart, would it?

Well, you have decided as a member to make that investment! ... or at least the lending gurus at SECU have made that mistake on your behalf! Remember this [link]:

✅ "Who "funds" our loans at the Credit Union? In 2021 and 2022 SECU made over $6 billion in 30-year fixed rate mortgages at around 3.25% and "funded" those loans with other SECU members' hard earned savings dollars!"[That means you!]

😎 Question:Why would anyone do that with your savings?

1) Because "they" have figured out how to pay SECU savers 4% on CDs, invest your funds at 3.25% and not lose money.

2) Because the overall average low rate being paid for all SECU deposits and savings is only @2.50%. So, earning 3.25% while paying 2.50% is a really great deal as long as you don't include our operating costs of 2.30%.

3) Although 30-year fixed rate mortgages are now over 6%, members will become very eager to refinance their existing 3.25% mortgages.

4) Rates will move lower and stay lower for the next 30 years. The Fed is targeting rates @2% so plus our operating expenses of 2.30%... well, don't exaggerate the loss.

5) Maybe SECU members won't notice for 30 years ... even with AI.

GSEs: People Helping People?

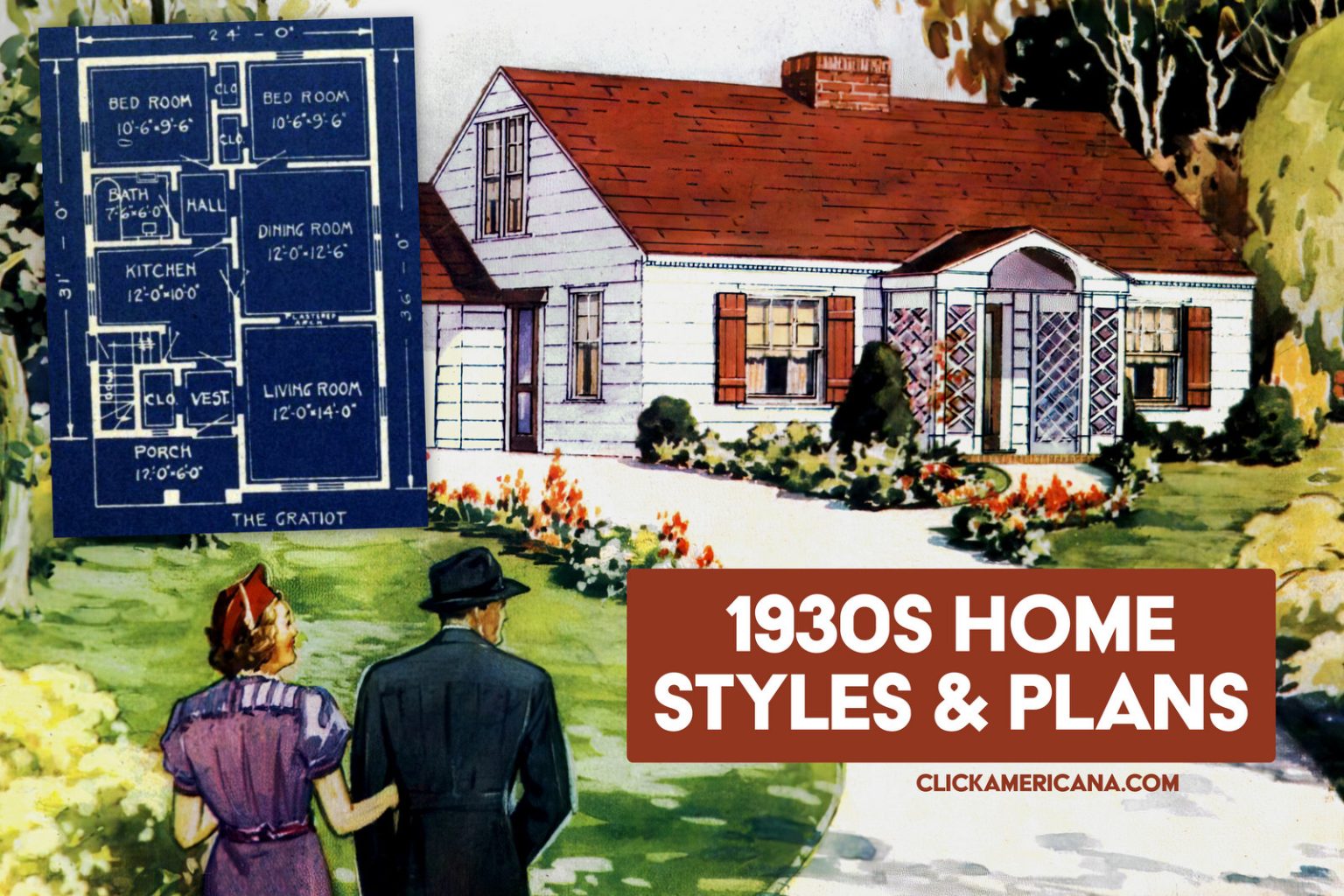

GSEs: People Helping People?You might think that I have some vendetta against GSE's (Fan/Fred) and the 30-year fixed rate mortgage. Not really. As they say, "it is what it is"... and that's not likely to change

In years passed, SECU became certified, originated, and sold mortgages to a GSE; the CEO at the time was even appointed to serve on the GSE's national credit union advisory council. SECU members believed that a 30-year fixed rate mortgage was a better choice - find a way to make that happen! A couple of problems quickly appeared:

1) We've already talked about the problem (2008) [link] of unlimited federal guarantees used to politically prop up these for-profit institutions' 1930's era self-interest.

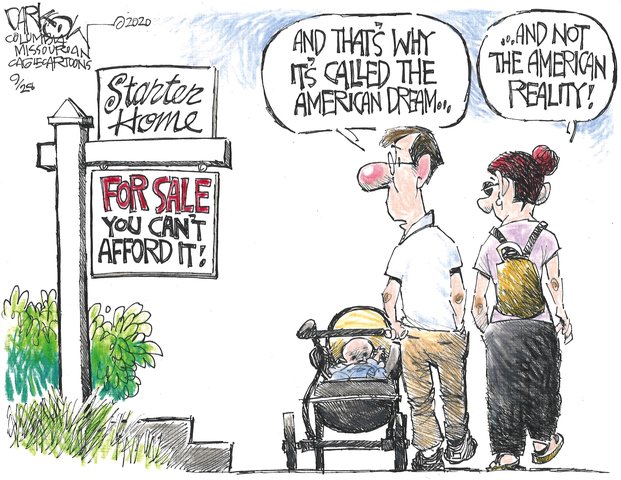

2) "The American Reality" was the 20% down payment and pristine underwriting requirements precluded most SECU members from qualifying - the GSEs basically just skimmed off the "no-risk" mortgages from N.C. banks and credit unions.

3) "The American Reality" was the financial goals of the for-profit GSE (make more money!) quickly came into conflict with the financial goals of the not-for-profit Credit Union (leave more money in members' pockets!). Fees, PMI, and other surcharges abounded!

3) "The American Reality" was when SECU sold a mortgage (6.25% for example) to the GSE, it was paid .25% "to service the loan" (collect payments, etc}. The real economic value in the mortgage (the remaining 6% in interest) was exported out of North Carolina, rather than retained to circulate in North Carolina communities (same type problem as exporting manufacturing jobs to China!)

4) "The American Reality" was SECU could not financially survive permitting the GSE to extract 95% of the value of the mortgage from the Credit Union - let alone the financial harm caused to local jobs, businesses, and the North Carolina economy.

5) The GSE "game" hasn't changed, still a taxpayer-supported problem waiting to happen again, a money loser for SECU, and an economic loss for North Carolina.

😎 😎 😎 Then was it possible to try and create a different mortgage that was a better deal for SECU members?

... and financing!

... and financing!

You read about that extra $9,000+ PMI fee you'll pay [link] if SECU sticks you with a 30-year fixed rate mortgage without a @20% down payment. With the typical "starter" home price in North Carolina now @ $300,000, that means first time home buyers need to cough up @ $60,000 - well beyond the means of most young SECU members!

Since the 1980's SECU has been making and managing 100% first-time home buyers mortgages to SECU member-owners. It was a struggle to get the Board to approve such a "risky" mortgage - it was different, it certainly wasn't "industry standard". SECU started with a trial program and the program proved exceptionally successful and created member loyalty a hundred times better than a Super Bowl ad!

😎 Try this basic logic which finally won the Board over: 1) the member borrowers both have steady jobs, 2) a mortgage is a low-risk loan [link] with the home as collateral if something goes wrong, 3) the borrowers have been reliably paying monthly rent that is about the same as the mortgage payment, 4) mortgage interest payments are tax deductible, 5) home prices are rising @3% a year which lowers the lending risk, 6) SECU earns more on a mortgage loan than on an idle T-bill investment, 7) home-ownership is "The American Dream", 8) the 100% mortgage will change the lives of two young SECU members - for the better ...

✅ 9) Isn't this what State Employees' Credit Union was created to do !

😎 Hope SECU members still agree with those principles - and purpose!

Why didn't you tell me this!

Why didn't you tell me this!

One more "little thing" about why a 30-year fixed rate is a mistake for members when a fairly priced ARM is available. (I know, I know you find that hard to believe).

✅ Here again is the example on a $300,000, 30-year mortgage loan [see entire post]:

"The monthly principal and interest payment on the 30-year fixed rate loan is $1,847 for the next 360 months (30 years).

The monthly principal and interest payment on the 5-year ARM is $1,476. the SECU borrower will save @ $22,260 ($1,847 - $1,476 = $371 savings per payment x 60 payments = $22,260) over the first 5 years. If market rates decline or don't move, the SECU member will save at least another $22,260 in the second five years!"

With the ARM you save $22,260 in the first five years, breakeven in terms of monthly payment amount in years 6-10 (would be $1,847, at worst - same as the fixed!), and so forth....

Fannie/Freddie require mortgage borrowers to have at least a 20% down payment to get their best fixed-rate. Most young SECU borrowers in particular have difficulty coming up with down payments of $60,000 and up! But an extra fee (called "PMI") is required if you don't. Without a 20% down payment, the SECU member would be required to pay an additional @$150 per month on that 30-year fixed rate mortgage, not so on the SECU ARM.

So, on top of that $22,260 you saved with the SECU ARM, you will save an additional $9,000 ($150 x 12 months x 5 years = $9,000!) with the no PMI requirement! With the ARM you'll be $31,260 ahead - that's @ 10% of the total cost of your home!!!!.

But the PMI penalty payment is worse than you think. The GSEs which bought your loan generally require you to continue to pay PMI until you mortgage gets down below that 20% down payment requirement. Wanna guess how long that will take?

To get your principal balance below $240,000 (80% x $300,000 = $240,000) will take until 2036 - 11 years! If your mortgage loan is sold by SECU, your PMI extra cost will be $19,800!

😎 A 30-year fixed rate mortgage is a costly, risky deal for the member and SECU!

What's the truth?

What's the truth?

"Just so laughable. 1930's thinking? You literally ran until retirement a 1980's thrift mortgage model. What's being recommended is the current, contemporary being employed by CU's and lenders that don't have 1 billion+ in bad mortgages on their books..."

😎 Do want to take one more moment to do a "Whoa, horse!" on the many comments that have been made along this line. Hopefully, they are just low-rent trolls or low-grade economy model AI responses. You know how unreliable anonymice can be!

✅ Pretty sure such comments are simply not true. Much room to criticize the "new/new" for poor lending policies, weak underwriting, and suspect collection practices, but none of those are caused by the ARM product.

As we all know, SECU has always been a prominent mortgage lender in North Carolina. Typically around 70% of all loans are mortgages at SECU; a large majority of those mortgages are ARMs!

Here's a ten year history of actual loan losses at SECU:

Year Mortgage Loan Charge-offs Total SECU Charge-offs

2017 $9.8 million $84 million

2018 $6.9 million $100 million

2019 $8 million $102 million

2020 $5.3 million $73 million

2021 $390,000 (!)(!) $50 million

2022 $0 (!) (!) (!) $96 million

2023 $700,000 (!) (!) $197 million

2024 $8 million (!) $234 million

2025 $2 million (thru 6/30) (!) $138 million (6/30)

✅ While representing @70% of the total loan portfolio, hope it's clear that even in the worst year (2017), SECU member mortgage loan charge-offs have always been less than 1/10th of one percent of all mortgage loans. Folks just don't default very often on their homes, if prudently underwritten!

Members have always honored their mortgage commitments to SECU - even in pandemics, regardless of up/down interest rates, recessions, job loss, divorce, death. SECU has never put members into mortgages that weren't in their best interest!

✅ Loan losses are soaring at SECU under the "new/new" - ARMs are not the problem - never have been!

The "Unbelieveables"...

The "Unbelieveables"...

😎 Commenter: Anonymous September 20, 2025 at 9:36 PM

"Since you went there, it’s easy for anyone to determine if we are in a rising or declining environment based on whether rates are actually moving up and down. So LA knows that, and so does anyone in the free world that tracks rates."

✅ Look at the graph one more time...

Federal Reserve Graph of 10-Year Treasury Note

...which is generally used as a base to set home mortgage rates.

Good bit of snarking in the comments [see here if you have some time to waste!] on whether LA actually has its act together on predicting interest rates. Common sense tells us they have no such ability or they would be sipping a margarita on the beaches of Jamaica, rather than working. Wouldn't you, if you could?

If as many commenters state "ARMs are better in a declining rate market", take another glance at the FED chart above. If you take the "kinks" out of the chart, here's how it looks:

Sure looks like a declining rate market!

Sure looks like a declining rate market!

😎 The data says there has been a declining rate market for over 40 years - difficult to say exactly what "LA knows"! There is, of course that upward "kink" over the last 18 months. If you haven't been paying attention, the President - and now the Fed! - have pledged to fix that by lowering rates.

September 18, 2025

Via Email

Re: Response to 9/10 Email [link]

Dear Mr. Blaine:

I write in response to your latest missive emailed to me and posted to your blog. I understand you wish to "discuss" other possible alternatives the Board could use in lieu of special meetings that allow members to submit governance-related resolutions to the Board. **You also question the wisdom of the bylaw provision requiring 10% of members to submit a written request to call a special meeting.As noted in previous correspondence to you, allowing member resolutions outside a special meeting would be inconsistent with the system of governance established by the SECU bylaws. The bylaws provide that "the board shall have the general direction and control of the affairs of this credit union." This provision and the provision requiring a written request of at least 10% of the membership to call a special meeting have been in effect since the founding of SECU in 1937. These provisions are nothing new and evidence sound organizational governance.

Make no mistake, we love to hear from our members (whether adversarial or constructive), and never assume the worst! Members can (and do) make suggestions to SECU. We've made it easier than ever for members to engage directly with us through our branches, website, mobile app, and Member Connects. While these options might not provide a platform susceptible to commandeering, they are a wonderful source of feedback for SECU.

Finally, while I appreciate all you have done for SECU, our communications have run their course on these issues. Please know that we thank you for your input and welcome your continued feedback, even as we conclude our participation in this letter writing campaign.

Very truly yours,

Cathleen M. Plaut, Chief Legal Officer

cc: Leigh Brady, CEO

** 😎 I take it that means no discussion is acceptable with SECU - unless, of course, 300,000 SECU members request a "Special Meeting" with you, is that right?

Federal Reserve Graph of 10-Year Treasury Note

...which is generally used as a base to set home mortgage rates.

😎 Anonymous September 19, 2025 at 9:13 PM "SECU employees do a great job at educating members about how an ARM is very often the better option. What would your argument be against offering a 30 year fixed if the member is educated on an ARM and still wants the 30 fixed?

First, I agree that SECU branch employees have done a remarkable job in explaining the benefits (many still have doubts!) of an ARM to a very, very skeptical membership. The 30-year fixed rate is the "industry standard"after all; and, those with vested interests in keeping it that way, emphasize the rising rate risk with some not so subtle boogeyman tactics.

Why? Because there is lots of money at stake (surprise, greed is involved!). Remember a 30-year fixed rate mortgage is a financial "heads I win, tails you lose" proposition for mortgage brokers, who now originate the vast majority of U.S. home mortgages.

✅ Here's the key for your consideration: A mortgage broker makes the loan, but doesn't "fund it". What do you mean "doesn't fund it"? Well, when we borrower to buy a home, "somebody" has to provide the money for the loan, right? (Most of us don't think about that side of the transaction!)

With brokers the investors are most often those GSEs (taxpayer guaranteed enterprises), currently under conservatorship by the Feds. The broker just wants to make the loan and isn't going to argue with you about which loan is best. A 30-year fixed rate is what you want, fix rate is what you get! The broker doesn't care because "somebody else" (the GSEs) is funding the loan; the broker isn't "on the hook".

😎 Lets take a look at the classic problem with an "SECU funded" 30-year fixed rate mortgage. See that low point in rates around 2021/2022, which was the result of the pandemic? Rates hit an all-time rock bottom.

Who "funds" our loans at the Credit Union? In 2021 and 2022 SECU made over $6 billion in 30-year fixed rate mortgages at around 3.25% and "funded" those loans with other SECU members' hard earned savings dollars!

Over the last 3 years, SECU has only been able to keep member deposits by paying 4% to 5% rates on CDs (the rest of member deposits earn substantially less!). Over the last 3 years, total SECU member CDs have grown from $4 billion to $15 billion - from less than 10% to @30% of total member deposits.

😎 SECU earns 3.25% for the next 30 years and pays members 4%/5%? Really? That's fantastic!

Yes, to all the above?

Yes, to all the above?

✅ Commenter: Anonymous September 20, 2025 at 1:05 PM

"So only ARM mortgages should be offered to SECU members? That is what you are stating?"

No, the concern is over the 30-year fixed rate mortgage [link], which most consumers think is better [link]; and the proposed future selling of our member mortgages into a huge, financially risky, taxpayer-guaranteed support system which failed in 2008 and has been in conservatorship for the last 17 years [link].

In a world where market interest rates can fluctuate widely (post 1980 federal deregulation), no reasonable lender or investor would normally make or purchase many 30-year fixed rate mortgages - a relatively low rate investment - unless Uncle Sam guarantees against losses when "things go bad" - and yes, they eventually will go bad [link].

SECU has been making fixed rate mortgages every year for over 75 years. In fact when deregulation hit in 1980, SECU was almost "loaned out" and had @ 50% of its assets (loans) in 30-year fixed rate mortgages at rates of 7% and 8%.

By 1981 after deregulation hit, SECU was paying 16% on a six-month CD (and some members were complaining that 16% was too low!). Earning 7% to 8% on those 30-year fixed rate mortgages while paying 16% and up on CDs... doesn't take a financial genius to figure out how that will turn out. The Savings and Loan industry (which made most home mortgages at the time) collapsed and disappeared. As a financial institution, you can't pay 16% and earn 8% for long!

✅ So let's look at SECU mortgage lending over the last few years:

Dec. 2022 New fixed >15yrs $2.25 billion

New fixed <15yrs $300 million

✔ ARMs $4.2 billion Total mortgages: $22.2B

Dec. 2023 New fixed >15yrs $560 million

New fixed <15yrs $195 million

✔ ARMs $3 billion Total mortgages: $24.3B

Dec. 2024 New fixed >15yrs $875 million

New fixed <15yrs $225 million

✔ ARMs $2.2 billion Total mortgages: $25.3B

June. 2025 New fixed >15yrs $373 million

New fixed <15yrs $129 million

✔ ARMs $1.6 billion Total mortgages: $$26. B*

* At June, 2025, SECU held 37,000 member fixed rate, >15 years mortgages totaling $7 billion, 25,000 fixed rate, <15 years mortgages totaling $2 billion, and 107,000 member ARMs totaling $17 billion

✅ If ARMs are so bad for SECU members, then why does the ELT and SECU Board keep "sticking it to the membership"?

😎 Must be that some of those Luddite, "new/new" commenters [link] are continuing to fumble around with their 1930/2008 ideology - it's been a costly misadventure for the SECU membership.

But, but, wait, wait...

But, but, wait, wait...

it's "industry standard"!

SECU members and most consumers believe that a 30-year fixed rate mortgage is a better choice than an ARM.

It just appears to make common sense, that if a borrower can lock in a fixed rate, it has to be better than a mortgage with a rate which might move upward, right?

Most folks think that way and the mortgage industry works hard to make you continue to believe so - because it's in their best interest. But we'll look at that later, let's focus on just the individual borrower for this round.

First consideration: The interest rate on an ARM can "move" in three directions: 1) lower, 2) not at all, 3) or higher. Hope we can agree that we only need to study one of those possibilities, i.e. (#3), because if rates move lower (#1) the ARM borrower will pay less; and, if rates don't move at all (#2) the borrower also pays less because ARM rates are priced lower than fixed rate mortgages (check it out!).

So, in two of the three possibilities for market rate shifts, the SECU borrower will pay less with the 30-year ARM mortgage. Easy enough, shouldn't be any arguments there.

Second consideration: But its that last possibility of rising market rates on which consumers focus, fearing rising monthly mortgage payments which they will not be able to afford. A very reasonable concern, but lets look at the facts.

You should know that the SECU Board and staff always used to look for financial solutions which were better for the members and left extra money in their pockets. Isn't that what a member-owned cooperative is supposed to do? Over the years numerous types of ARMs were tried (1 yr, 2 yr, 3yr ARM versions etc). The 5-year ARM seemed to be the best fit and also is the mortgage most used in developed countries.

The example: The 5-year ARM rate can adjust only every 5 years by no more than 2% and by no more than a total of 6% over the 30 year life of the loan. In our example, we use the average price of a new home ($300,000) and a fixed rate of 6.25% and an ARM rate of 4.25%. (Doesn't matter which house price you use [down-payment, taxes, insurance other fees are assumed to be @ the same] or whether you use a different current market rate...the relative calculation results will be the same)

The monthly principal and interest payment on the 30-year fixed rate loan is $1,847 for the next 360 months (30 years).

The monthly principal and interest payment on the 5-year ARM is $1,476. the SECU borrower will save @ $22,260 ($1,847 - $1,476 = $371 savings per payment x 60 payments) over the first 5 years. If market rates decline or don't move, the SECU member will save at least another $22,260 in the second five years!

Worst case: But what happens if rates soar?!!? Well, the SECU member's rate will increase in years 6-10 to 6.25% and the monthly payment will be $1,847 - the same rate and payment as the 30-year fixed rate - except the member is still ahead $22,260! In year 11-15 if rates jump another 2%, then the $22,260 gain will disappear, but the ARM borrower will still be better off due to lower fees and mortgage insurance costs.

😎 An SECU ARM borrower in the worst case is a sure winner ($22,260!) in the first 5 years and no worse off through at least the first 15 years. If market rates decline, the SECU ARM borrower is a sure winner every year the ARM lasts. If market rates remain the same, the SECU ARM borrower is a sure winner every year the ARM lasts.

✅ Might note that the average 30-year mortgage lasts only 12 years. (A recent commenter said that it was now 7 years, not 12 years, which actually makes the case for the ARM even better!) Under any circumstances, few 30-year fixed rate mortgages last more than 12-15 years.

✅ Might also note that President Trump - and now the Federal Reserve - are predicting that market rates are declining - and will continue to do so.

Holy Cow! Why keep stepping in it?

Holy Cow! Why keep stepping in it?

Been talking about SECU's latest proposed "innovative" misstep - selling of SECU member mortgages to government sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac [link].

GSEs exist now primarily to prop up the 30-year fixed rate mortgage [link]. They only continue to exist because US taxpayers - that's you and me - guarantee foreign and domestic mortgage investors against loss on this financially risky mortgage loan product.

You should note that these private, for profit companies went bust in the 2008 financial crisis and had to be bailed out by U.S. taxpayers - that's you and me. When Fannie Mae and Freddie Mac went "belly up" U.S. taxpayers - that's you and me - had no choice but to pick up the pieces for these private, for profit companies.

Critics claim that a federal government guarantee of these GSEs "privitizes profits and socializes losses". When things are good private investors reap the rewards, when things go wrong U.S taxpayers - that's you and me - eat the losses. It's better known as: "Heads we win, tails you lose!"

✅ For the last 17 years, the U.S. government has owned and controlled ("conserved") Fannie Mae and Freddie Mac. Both are "wards of the state".

There is much controversy and debate about what to do next with Fannie and Freddie to avoid another financial meltdown and crisis in the U.S mortgage market. President Trump has thrown out several alternatives [link].

The economic and political debate is fierce [link]. The future for these two problemmatic private companies highly uncertain.

😎 Why would our new/new "lending gurus" at SECU propose stepping into this mess?

Fixed rates require a lot of claptrack ...

Fixed rates require a lot of claptrack ...

If you're still there, we're taking a look at the latest mortgage "innovations" proposed by our "new/new" lending 'mavins" (have you looked up Luddites yet?) at the CU.

Asked a couple of questions along the way. You've indicated that you didn't know the U.S. was the only country still using the 30-year fixed mortgage, thought the American Dream of home ownership was a good idea and that tax payers guaranteeing mortgages for private companies (Fannie, Freddie, etc) couldn't be true. (It is!)

We talked about how these government "sponsored" enterprises (GSE's) were created out of the financial turmoil of the Great Depression [link], but then refused to die when the crisis had passed. They zombied!

The final "nail in the coffin" of fixed rate mortgages was the 1980 deregulation of savings rates. Prior to that time, believe or not, financial institutions were restricted by the federal government as to the savings rates they could pay.

Rates didn't change much and CD's and MMSAs didn't exist. With the advent of deregulation, market savings rates began fluctuating (and still do!) wildly and rose as high as 21%! 30-year fixed rate mortgages no longer made sense; the Savings and Loan institutions which held mostly fixed rate mortgage loans collapsed.

But as we know, zombies never die, so even more elaborate "work-arounds" (derivatives, hedging, securitization - you really don't want to go down these rabbit holes!) were created to try and preserve the 30-year fixed rate mortgage dinosaur. These innovations in finance - we were assured - made fixed rate mortgage lending a safe and sound investment.

That fairy tale was hyped and sold to the public and taxpayers, because billions of dollars and careers were at stake - still are! The bubble burst in 2008 and reality came home to roost - the mortgage market collapsed, Fannie and Freddie went broke, you and I as taxpayers picked up the trillion dollar tab.

Don't believe all that? Try looking up the 2008 financial panic [link] or just watch the movie "The Big Short" [link]! And the "new/new" now wants to reinvent and repeat this mortgage mistake at SECU?

Tomorrow we'll get off the history lessons and I'll show you why an ARM is better for you as a home buyer, for SECU savings members, and for the North Carolina economy.

😎 Enjoy "The Big Short"!