People Helping People - Really?

People Helping People - Really?

😎 Was trying to hurry and finish up on the fixed-30/ARM discussion, because educating folks on mortgages in a few blog posts is overly ambitious, too technical, and downright dull. But had a long-time member/former employee, whom I greatly admire, submit a comment that demonstrates the reality of on-going member concern. Here take a look [link - first comment].

Regardless of what is said, members are going to "worry" about an ARM! In this case if the worry is too great, sound advice is given (2nd commenter) to consider refinancing to a fixed rate, especially if you have 20%+ equity in the home.

SECU "new/new" lenders have stumbled into a blind alley on SECU mortgages and are taking the members along for the ride . How so? We've discussed why selling member mortgages to the failed, tax-payer subsidized, for-profit GSEs (Fan/Fred) is a mistake [link] waiting to happen - again! , will reduce the ability for SECU to help first-time home buyers, will strip the interest paid from local N.C. communities (and SECU savers!), exporting it to countries like China/Japan [link], will actually increase the cost of a mortgage for SECU borrowers, and will end the role of SECU as a high-value alternative mortgage source for North Carolinians.

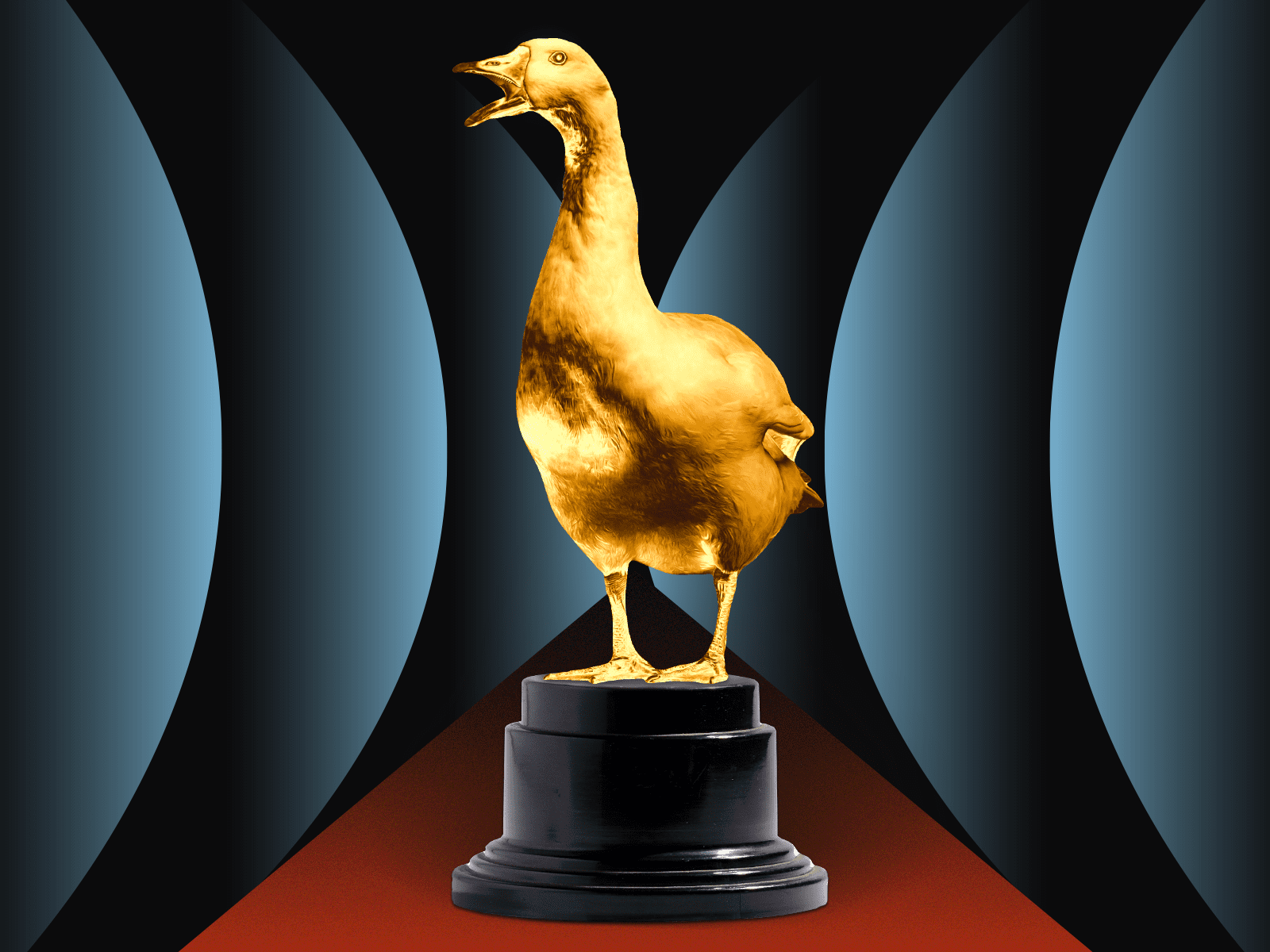

"New/new" has killed the golden goose? [link] Yes! 1) Sound financial institutions aren't allowed to hold many 30-year fixed rate mortgages on their books. SECU "new/new" has just filled that risk bucket to overflowing with the lowest fixed rate mortgages in recorded history [link] (@3%range) - and can't take on more, only choice left is to sell them to Fran/Fred!! 2) Then to make matters remarkably worse, the SECU "new/new" have now unfavorably mis-priced the SECU ARM to the severe detriment of potential member borrowers .

"New/new" has killed the golden goose? [link] Yes! 1) Sound financial institutions aren't allowed to hold many 30-year fixed rate mortgages on their books. SECU "new/new" has just filled that risk bucket to overflowing with the lowest fixed rate mortgages in recorded history [link] (@3%range) - and can't take on more, only choice left is to sell them to Fran/Fred!! 2) Then to make matters remarkably worse, the SECU "new/new" have now unfavorably mis-priced the SECU ARM to the severe detriment of potential member borrowers .

✅ As currently priced [link], the SECU 30-year fixed rate is at 6.0%, the posted SECU ARM rate is at 5.6%. less than a 1/2% difference.

😎 No SECU mortgage borrower should take on the "worry" of an ARM at 5.6% when a fixed rate is available for < 1/2% more! Current SECU ARM pricing is an egregious betrayal of SECU member trust by the "new/new".

✔ So, dear friend commenter, not sure of the details on your current mortgage, but any new SECU ARM borrower should be rightfully "worried"...

"egregious betrayal of trust"? dramatic much? the true betrayal of trust, and financial malpractice, is enticing members into high risk loans. You are literally seem to be the only one that doesn't see that.

ReplyDelete11:28 am Hey not arguing with you, think you nailed it!

ReplyDeleteAs you say: "... true betrayal of trust, and financial malpractice, is enticing members into high risk loans" ... and that is exactly what the mis-pricing of the SECU ARM is... as the post points out.

The trust of the members is really all SECU ( or any business) has... hope you don't find that idea to be "dramatic much", then again perhaps you do!

SECU lost this members trust years ago when SECU's Board hired Jim Hayes to run it. (into the ground!)

ReplyDeleteditto ... one of those things you can't buy!

Delete