Fair game?

The notice and procedures for the SECU Annual Meeting [link for full info} have been published.

😎 Be sure to look at this one: "Rule 4. Up to one hour will be set aside during the meeting for a question-and-answer session. Members must submit any questions in advance of the meeting. To permit as many members to ask questions as possible, we ask that you limit yourself to one question or topic."

"Members will be requested to provide us their name and city of residence. We intend to answer as many questions as time allows. If we receive multiple questions on the same topic, we may group them together and respond to them collectively. If there are questions that we are unable to answer during the question-and-answer session and are of general interest to members, we will post a summary on our website after the meeting."

"While we welcome member questions, we will not address questions that (i) are not relevant to SECU, (ii) contain offensive or otherwise inappropriate language, derogatory references to individuals, or that otherwise are in bad taste, (iii) relate to pending or threatened litigation, (iv) are repetitious of questions asked by others, (v) relate to personal matters, such as individual employee relation matters or individual member account issues, or (vi) are otherwise determined by the Chair to be inappropriate or otherwise not suitable for response during the Annual Meeting."

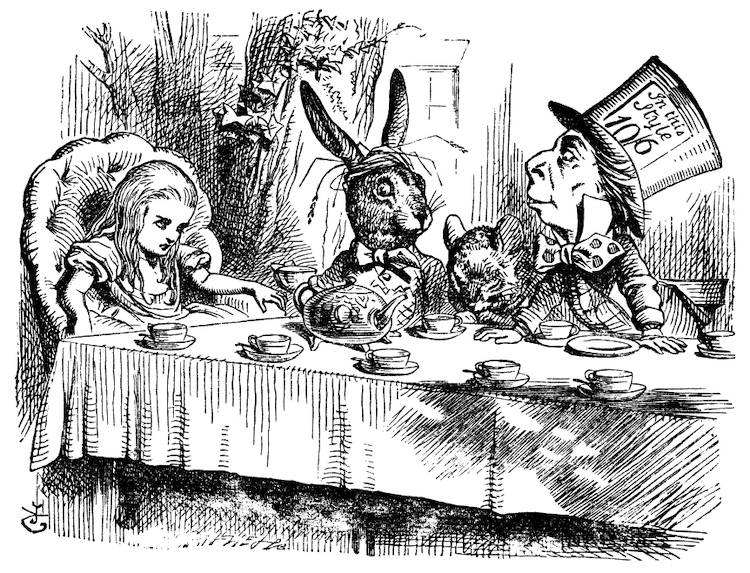

✅ The SECU Board of Directors tend to think of themselves as open-minded and supportive of free speech. But this rule and other recent examples show otherwise—and prove that the Board as a group is not above using intimidation and harassment to silence dissenting voices.

😎 In the long run, it's hard to hide one's true colors. The SECU Board seems to be tending increasingly toward dress khaki...